LESSON ONE ACCOUNTING: AN INFORMATION SYSTEM

Accounting is an information system necessitated by the great complexity of modern business.

One of the most important functions of accounting is to accumulate and report financial information that shows an organization’s financial position and the results of its operations to its interested users. These users include managers,stockholders,banks and other creditors, governmental agencies,investment advisors, and the general public. For example, stockholders must have an organization's financial information in order to measure its management's performance and to evaluate their own holdings. Banks and other creditors must consider the financial strength of a business before permitting it to borrow funds. Potential investors need financial data in order to compare prospective investments. Also,many laws require that extensive financial information be reported to the various levels of government. Businesses usually publish such reports at least annually. To meet the needs of the external users, a framework of accounting standards, principles and procedures known as ‘‘generally accepted accounting principles” have been developed to insure the relevance and reliability of the accounting information contained in these external financial reports. The subdivision of the accounting process that produces these external reports is referred to as financial accounting.

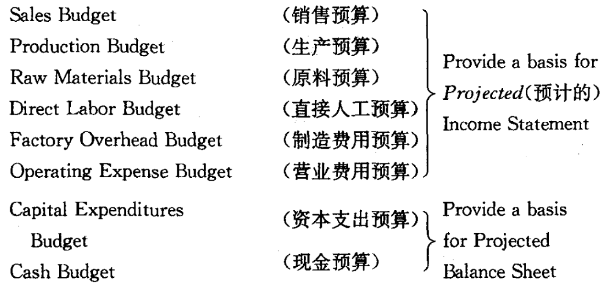

Another important function of accounting is to provide the management inside an organization with the accounting information needed in the organization’s internal decision-making,which relates to planning, control,and evaluation within an organization. For example,budgets are prepared under the directions of a company's financial executives on an annual basis and express the desires and goals of the company’s management. A performance report is supplied to help a manager focus his attention on problems or opportunities that might otherwise go unnoticed. Furthermore, cost-benefit data will be needed by a company’s management in deciding among the alternatives of reducing prices,increasing advertising, or doing both in attempt to maintain its market shares. The process of generating and analyzing such accounting information for internal decision-making is often referred to as managerial accounting and the related information reports being prepared are called internal management reports. As contrasted with financial accounting, a managerial accounting information system provides both historical and estimated information that is relevant to the specific plans on more frequent basis. And managerial accounting is not governed by generally accepted accounting principles.

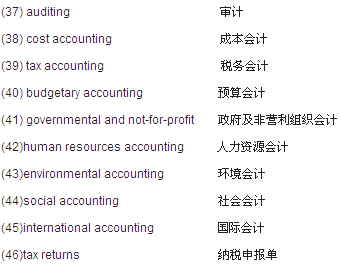

The growth of organizations,changes in technology, government regulation, and the globalization of economy during the twentieth century have spurred the development of accounting. As a result, a number of specialized fields of accounting have evolved in addition to financial accounting and managerial accounting, which include auditing, cost accounting, tax accounting, budgetary accounting, governmental and not-for-profit accounting, human resources accounting, environmental accounting, social accounting, international accounting, etc. For example, tax accounting encompasses the preparation of tax returns and the consideration of the tax consequences of proposed business transactions or alternative courses of action. Governmental and not-for-profit accounting specializes in recording and reporting the transactions of various governmental units and other not-for-profit organizations. International accounting is concerned with the special problems associated with the international trade of multinational business organizations. All forms of accounting, in the end, provide information to the related users and help them make decisions.

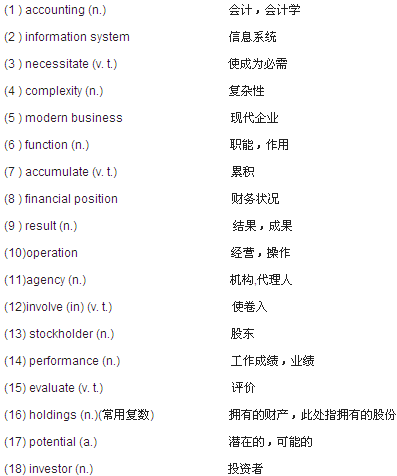

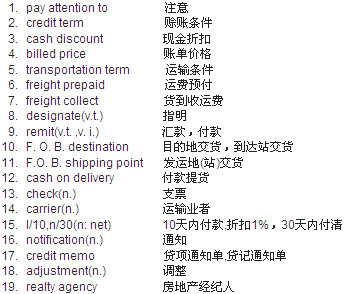

New Words, Phrases and Special Terms

Notes to the Text

1.Accounting is an information system necessitated by the great complexity of modern business.

过去分词短语necessitated by…修饰句中表语an information system.

2.One of the most important functions of accounting is to accumulate and report financial information that shows an organization’s financial position and the results of its operations.

(1)不定式复杂结构to accumulate and report financial information…是句中的表语。

(2)在这一复杂结构中,由关系代词that引导的定语从句修饰financial information.

3. Bankers and other Creditors must consider the financial strength of a business before permitting it to borrow funds.

(1)动名词短语permitting it to borrow funds 用作介词before 的宾语。

(2)动名词permitting的复合宾语中,宾语it的补语是不定式短语to borrow funds.

4.Also,many laws require that extensive financial information be reported to the various levels of government.

(1)主句谓语动词require的宾语是由连词that引导的从句。

(2)这一宾语从句中的谓语动词be reported属祈使语气,其前的should可省略。

READING MATERIAL

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

Financial accounting relies on certain standards (准则) or guides (指南)that have proved useful over the years in imparting economic data. These standards are called generally accepted accounting principles (公认会计原则).They are closely related to experience and practice and may change over time. Various terms, such as principle,standard,assumption(假设),convention(惯例),and concept (概念) ,are often used to describe such guides.

The most fundamental concepts underlying the accounting process are:

Accounting Entity(会计主体).Each business venture(企业) is a separate unit, accounted for separately.

Going Concern(持续经营).The assumption is made in accounting that a business will continue indefinitely.

Measuring Unit (计量单位).Conventional accounting statements (传统会计报表)are not adjusted for changes in the value of the dollar.

Accounting Period (会计期间).Accounting reports are related to specific time periods,typically one year.

Historical Cost(历史成本).Assets are reported at acquisition price (取得价格)and are not adjusted upward.

Objectivity(客观性).Whenever possible,accounting entries must be based on objectively determined evidence.

A number of organizations exist in U. S. A. that are concerned with the formulation of accounting principles. The most prominent among them is the Financial Accounting Standards Board(FASB财务会计准则委员会).The FASB,organized in 1973,is a nongovernmental body(f非政府机构)whose pronouncements have the force of dictating authoritative rules for the general practice of financial accounting. Before the creation of the FASB,the Committee on Accounting Procedure (CAP,会计程序委员会)and latter the Accounting Principles Board (APB 会计原则委员会)of the American Institute of Certified Public Accountants ( AICPA美国注册会计师协会)fulfilled the function of formulating accounting principles.

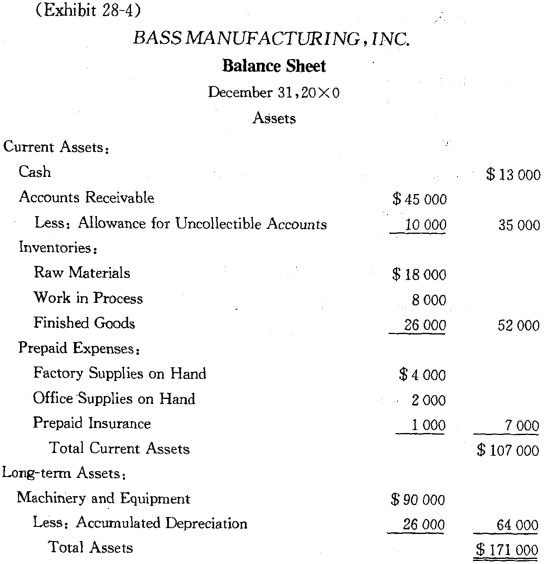

LESSON TWO ASSETS SECTION OF BALANCE SHEET

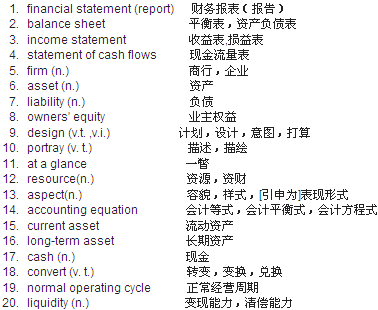

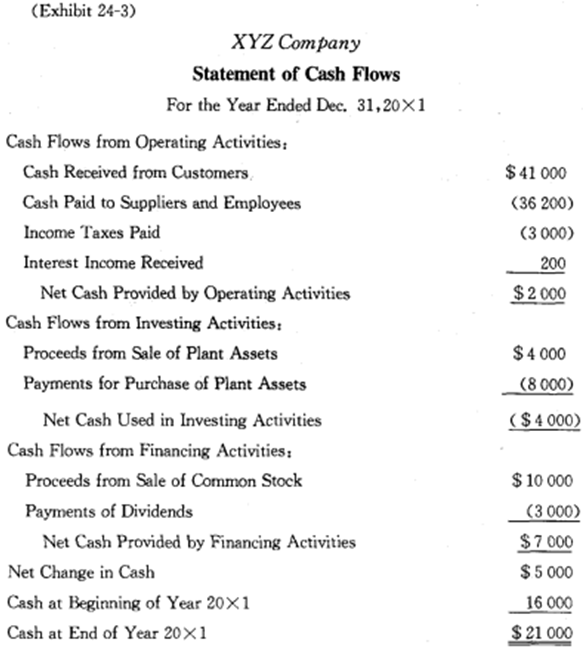

There are three basic financial statements which are the end products of financial accounting: Balance Sheet, Income Statement and the Statement of Cash Flows. The nature and formats of the first two statements will be illustrated in this and the following two lessons. Balance sheet and income statement are prepared at least yearly, but it is also customary to prepare them quarterly or monthly.

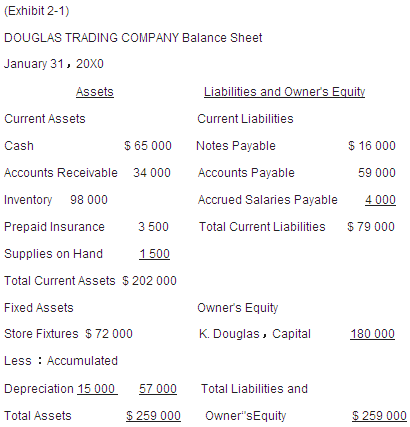

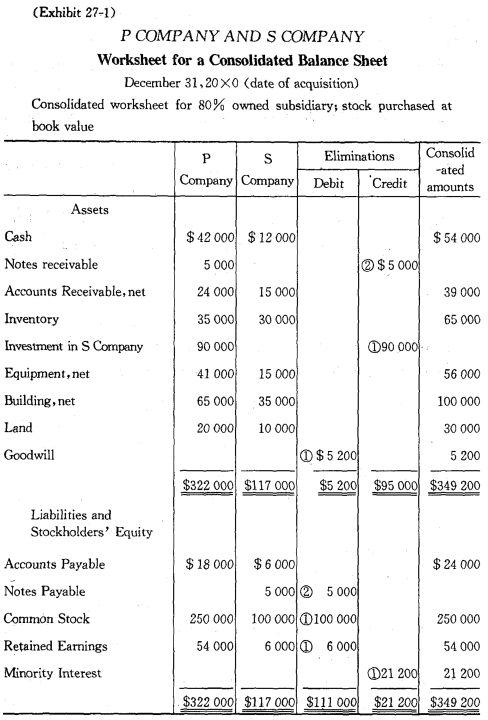

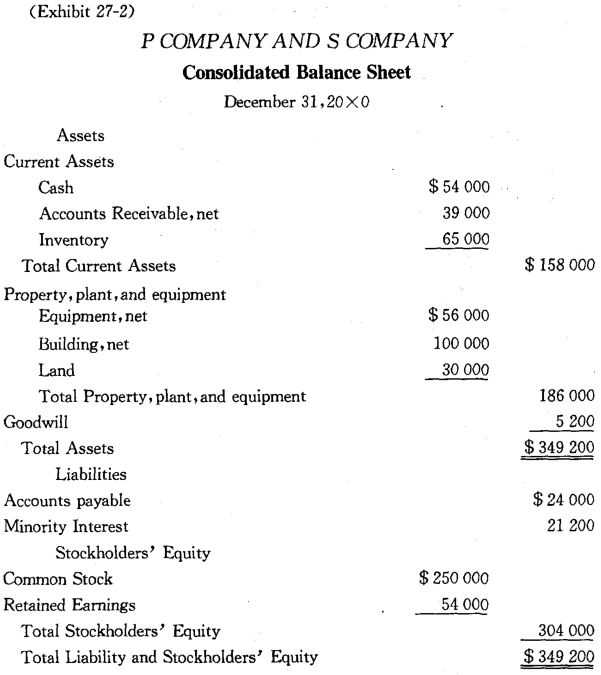

Balance Sheet is a listing of an organization’s assets, liabilities and owners’ equity on a given date. It is designed to portray the financial position of the organization at a particular time (e. g., on January 31,2000). As presented in Exhibit 2-1,the three major sections of the balance sheet are presented in the T-account format. This presentation allows the users to tell at a glance that total assets (e. g.,$ 259 000) are being financed by two sources : $ 79 000 by the creditors (i. e., liabilities) and $ 180 000 by the owner (i. e.,owners’ equity). An important aspect of this statement is that the total assets always equal the sum of liabilities and owner’s equity. This balancing is sometimes described as theaccounting equation: Assets = Liabilities + Owners’ Equity. This lesson deals with the assets section of a balance sheet. The liabilities and owner’s equity section will be discussed in Lesson Three.

Assets are the economic resources of an organization that can usefully be expressed in monetary terms. The assets of Douglas Company have been further classified into current assets and long- term assets. Current assets are cash and other assets that will be converted into cash or used up during the normal operating cycle of the business or one year, whichever is longer. Current assets are usually listed in the order of their “liquidity” or convertibility into cash. Some examples of current assets other than those shown in Exhibit 2-1 are notes receivable and marketable securities. Prepaid expenses such as insurance, rent, and supplies are normally consumed during the operating cycle rather than converted into cash.

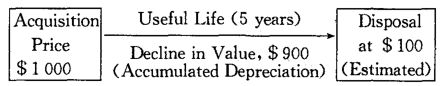

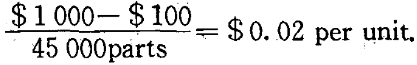

Long-term assets are relatively long-lived assets used in operating an organization and may be further classified into fixed assets, or plant and equipment, and intangible assets. Fixed assets may include land, buildings, and various kinds of equipment (machinery, store fixtures, office equipment, delivery equipment, etc.). They constitute the major category of long term assets. Depreciable assets are normally shown at their original cost. The accumulated portion of the cost taken as depreciation to date is subtracted from its original cost to obtain the book value of the asset. Intangible assets are characterized by the legal claims or rights which may include patents, trademarks, franchises, copyrights, goodwill, etc..

New Words, Phrases and Special Terms

Notes to the Text

1.Financial statements are prepared at least yearly, but it is also customary to prepare them quarterly or monthly.

(1)用连词but连接的并列句。

(2)在 it is also customary to prepare…这一分句中,it作引词,是分局内的形式主语,真正主语是不定式短语toprepare…。

2.This presentation allows the users to tell at a glance that total assets (e. g.,$ 259 000)are being financed by two sources: $ 79 000 by the creditors (i. e., liabilities) and $ 180 000 by the owner (i. e., owner's equity).

(1)全句的谓语动词 allows的复合宾语 thereader+to tell…that …and that…,,不定式复杂结构 to tell…在复合宾语中作补语。

(2)不定式to tell的宾语是用连词and连接的两个并列的从句,每一从句都用连词that引导。

3. An important aspect of this statement is that the total assets always equal the sum of liabilities and owners’ equity.

(1)由连词that引导的从句,在全句中作表语。

(2)equal用作动词时,是及物动词(如句中);equal也可用作形容词, 这时后面才接用介词to。

4. Current assets are cash and other assets that -will be converted into cash or used up during the normal operating cycle of the business or one year , whichever is longer.

(1) 限制性定语从句thatwill be converted …or used up…修饰全句的表语cash and other assets中的other assets。

(2)这一从句中还包含一个非限制性的定语从句whichever is longer,修饰 the normal operating cycle of the business or one year。

5. Long-term assets are relatively long-lived assets used in operating an organization and may be further classified into fixed assets, or plant and equipment, and intangible assets.

(1)简单句型。连词and连接两个并列的谓语:are…and may be…

(2)or"plant and equipment”是 fixed assets 的同位语。

(3)修饰relatively long-lived assets 的过去分词短语 used in operating the business中,介词in的宾语是动名词短语operating an organization。

READING MATERIAL

FIELDS OF ACCOUNTING ACTIVITY

Accountants(会计人员) perform many diverse(多种多样的) services and are engaged in various types of employment .The three major fields of accounting activity (会计活动)are private accounting (私人企业会计), public accounting (公众会计,注册会计师业务),and governmental accounting (政府会计).

More accountants are employed in private accounting than in any other field. Private employers of accountants include manufacturers, wholesalers, retailers, and service, firms. In many large companies, the head of the accounting department is called the financial executives.

The field of public accounting is composed of firms (事务所)that render independent, expert reports on financial statements of business enterprises. Public accounting firms(会计师事务所)also perform a wide variety of accounting and managerial services, acting as consultants (顾问) of their clients. Most accountants in a public accounting firm are certified public accountants {CPAs 注册会计师).

A large number of accountants are employed by federal(联邦),state (州)and local (地方) government The services performed by these accountants parallel those of private and public accountants and may cover the entirespectrum(范围)of financial and managerial accounting.

LESSON THREE LIABILITIES AND OWNERS’EQUITY SECTION OF BALANCE SHEET

Liabilities, or creditors,equity, are the obligations,or debts, that the firm must pay in money or services at some time in the future. They therefore represent creditors’ claim on an organization’s assets and are listed in the order that they come due. Current liabilities are those obligations that require to pay within the normal operating cycle or one year, whichever is longer,by the use of existing current assets or the creation of the other current liabilities. Examples of current liabilities include accounts payable, accrued wages and salaries payable, sales and excise taxes payable, income or property taxes payable, and short-term notes payable, dividends payable, estimated or accrued liabilities, the various payroll taxes liabilities and the portion of long-term debt due within one year (or the operating cycle, if longer). Also, it is customary to include in this category any amounts an organization has received from customers but has not yet earned as revenue. Generally speaking, current liabilities should be measured and shown in the balance sheet at the money amount necessary to satisfy the obligation.

Long-term liabilities are those amounts of debts not due for a relative long time, typically more than one year. Long-term notes, mortgages, and bonds payable are a few examples. Douglas Company has had no long-term debts when its balance sheet was prepared on January 31,20X0.

The owners,equity is referred to as the net assets of the business, which is defined as the difference between the assets and liabilities. Thus, owners,equity is a residual claim-a claim to the assets remaining after the debt to creditors has been discharged.

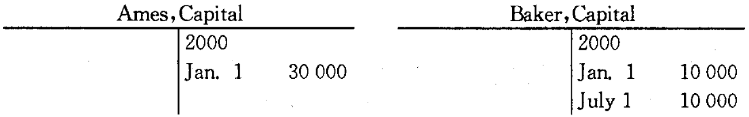

The principal differences in the balance sheets for the three forms of business organizations—the single proprietorship, the partnership and the corporation--appear in the owners,equity section. Corporation laws in many countries require that corporations segregate, in their balance sheets, the capital stock (owners,investment) and any retained earnings. Because there are no comparable legal restrictions on sole proprietorships and partnerships, these forms of organizations do not have to distinguish between amounts invested by owners and undistributed earnings.

The owners may from time to time withdraw money or property from the organization for personal use or to engage in other business activities. Such withdrawals reduce both the assets and the owners’ equity of the organization. In sole proprietorships and partnerships, withdrawals are made quite informally at the owners,discretion; in corporations,withdrawals must be accomplished more formally. The board of directors, elected by stockholders, must meet and "declare a dividend",before a distribution can be made to the stockholders. Declaration of dividends reduces the retained earnings portion of the owners, equity of the corporation and creates a liability called Dividends Payable. Payment of the dividend eliminates the liability and reduces assets (usually cash).

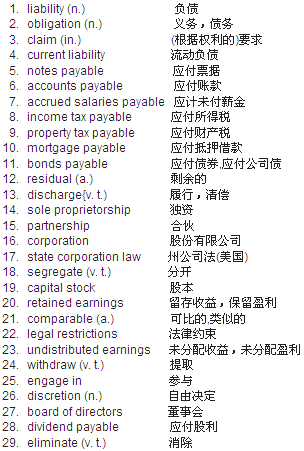

New Words, Phrases and Special Terms

Notes to the Text

1.Liabilities, or creditors’ equity, are the obligations, or debts, that the firm must pay in money or services at some time in the future.

(1)or creditors’ equity 是句中主语liabilities 的同位语,or debts 是表语the obligations的同位语。

(2)关系代词that引导的限制性定语从句,修饰the obligations。

2. The owners’ equity is referred to as the net assets of the business, which is defined as the difference between the assets and the liabilities.

修饰the net assets的定语从句是非限制性的。非限制性定语从句常用关系代词which引导,从句前并加逗号“,”。

3.State corporation laws require that corporations segregate,in their balance sheets, the capital stock (owners’ investment) and any retained earnings.主句谓语动词require的宾语是用连词that引导的从句。从句中的谓语动词segregate属祈使语气(参见第一课注释4)。

4. Because there are no comparable legal restrictions on sole proprietorships and partnerships, these types of businesses do not have to distinguish between amounts invested by owners and undistributed earnings.

(1)全句包含一个用连词because引导的原因状语从句。

(2)在两件事物间作出区分时,如distinguish作为不及物动词,其后常接用介词between(如句中);如作为及物动词,则要写成“distinguish…from…”,以本句为例,这一不定式短语也可写成to distinguish undistributed earnings from amounts invested by owners.

5.The board of directors, elected by the stockholders,must meet and “declare a dividend" before a distribution can be made to the stockholders.

(1)全句包含一个用连词before引导的时间状语从句。

(2)过去分词短语elected by the stockholders修饰主句主语the board of directors,因是非限制性定语,故用逗号“,”分开。

READING MATERIAL

THE STATEMENT OF OWNERS' EQUITY

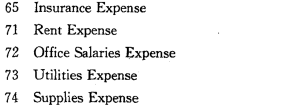

In the sole proprietorships and partnerships, a statement of owners’ equity(业主权益表)is frequently prepared to accompany the balance sheet and income statement. This is simply a summary of the changes in the owners’ capital balance during the accounting period. The following exhibit shows this type of statement for Douglas Trading Company. Note that the ending balance on this statement agrees with the owners’ capital balance on the balance sheet at Jan. 31,20X0.

This statement further demonstrates the relationship between the income statement and the balance sheet. The net income (or net loss) for a period in the income statement (see Lesson Four) is an input(投人数额) into the statement of owners’ equity,while the ending owners’ equity balance on this statement is an input into the balance sheet at the end of the period.

LESSON FOUR INCOME STATEMENT

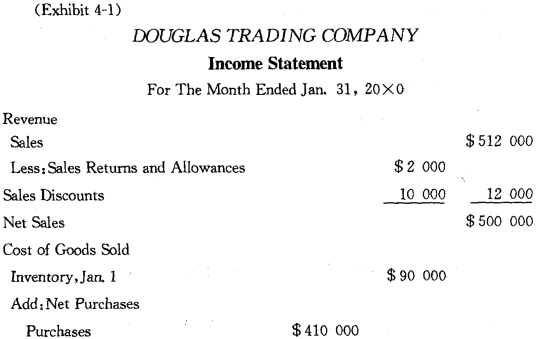

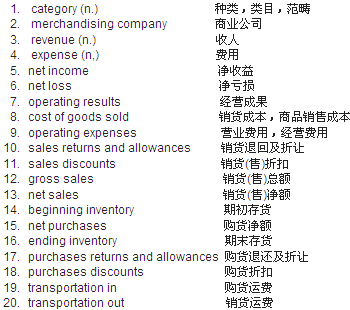

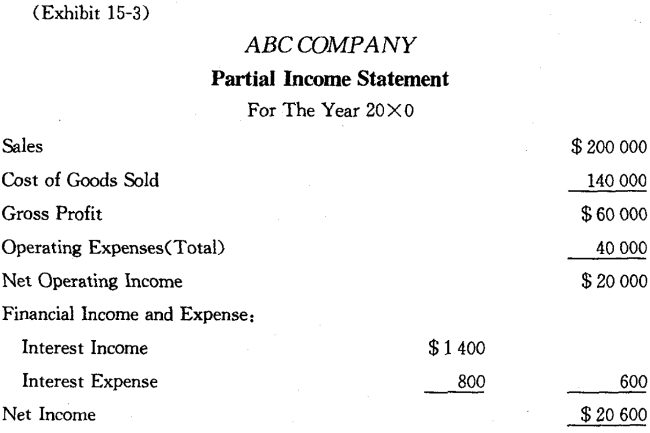

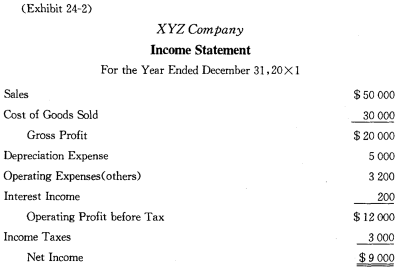

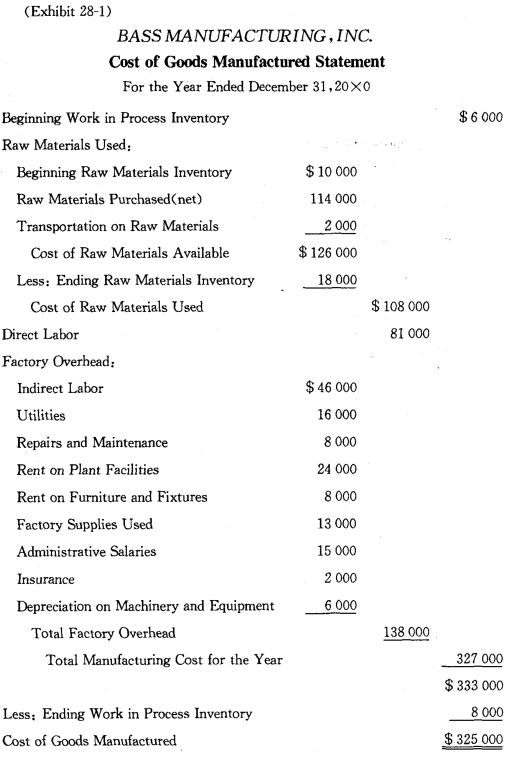

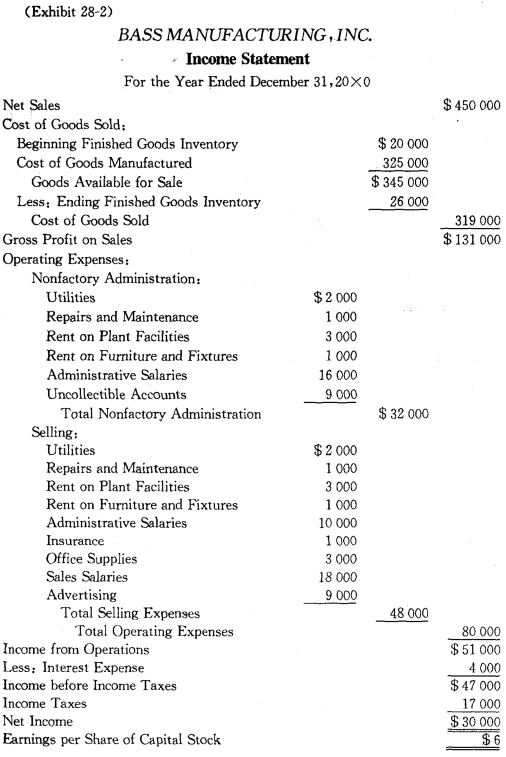

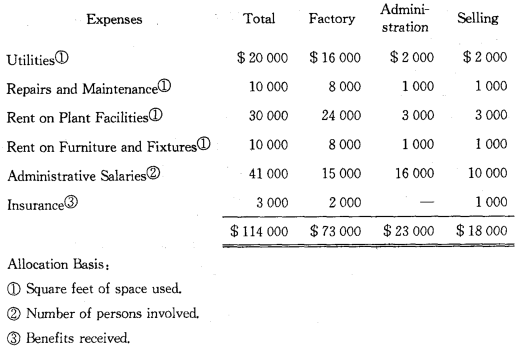

Income Statement is designed to portray the operating results for a period of time. Exhibit 4-1 is the income statement of Douglas Trading Company for the month ended January 31,20X0.

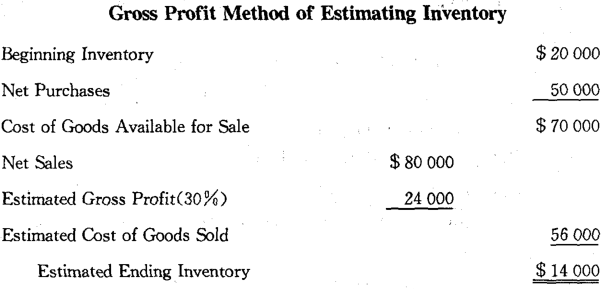

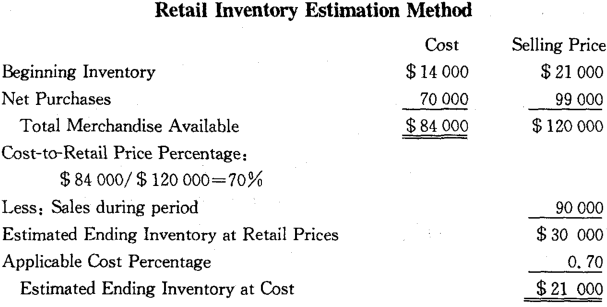

The major categories of the income statement for a merchandising company are revenue, cost of goods sold and operating expenses. In the revenue section, sales returns and allowances and sales discounts are deducted from the gross sales to yield net sales. The cost of goods sold is obtained by adding the beginning inventory and net purchases and deducting the ending inventory. To calculate net purchases, we deduct purchases returns, allowances and discounts from the purchases amount and add transportation costs of purchased goods. By deducting the cost of goods sold from the net sales,we arrive at an intermediate amount called gross profit on sales. The operating expenses are then deducted from the gross profit on sales to obtain the net income for the period.

The operating expenses of a merchandising business are typically classified into selling and administrative expenses. Some business items affecting the determination of a final net income amount may not relate to the primary operating activity of the business. Interest income and interest expense, for example, may be viewed as relating more to financing and investing activities than to merchandising efforts. They are often shown in a separate category called “Financial Income and Expense” at the bottom of the income statement. Likewise,any extraordinary items, such as catastrophic loss from an earthquake, will be shown in a separate “Extraordinary Items”category before the final net income amount is figured. Douglas Trading Company had no transactions or events to list in either of these categories on its income statement.

Operating results summarized by the income statement will be reflected in the owners’ equity section on the balance sheet at the end of that period. For yearly financial statements, the complementary relationship might be shown graphically as follows:

Dec. 31,20X0 Year 20X1 Dec. 31, 20X1 Year 20X2 Dec. 31,20X2![]()

The financial statements illustrated in this text are all prepared on the accrual basis.

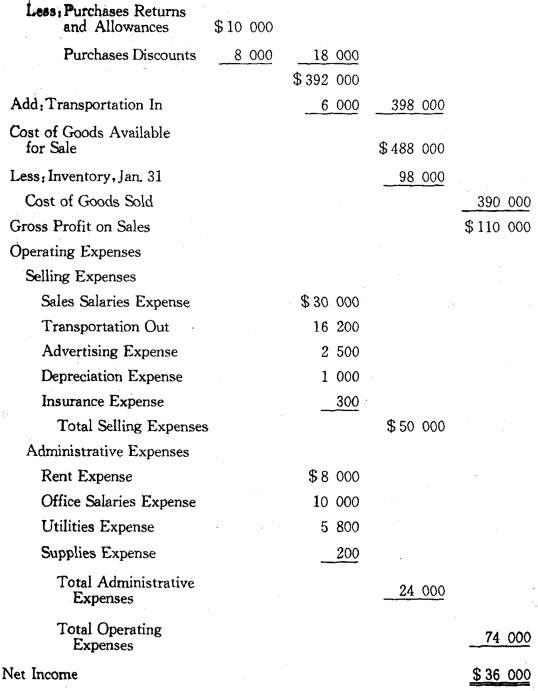

New Words, Phrases and Special Terms

Notes to the Text

1.Interest income and interest expense, for example, may be viewed as relating more to financing and investing activities than to merchandising efforts.

(1)for example 是插入语。

(2)作为介语as的宾语的动名词短语relating more to…than to…,用more…than连接起来,形成对比结构。relate后要接用介词to.

2. Likewise, any extraordinary items, such as catastrophic loss from an earthquake,will be shown in a separate "Extraordinary Items”category before the final net income amount is figured.

(1)全句包含一个用连词before引导的时间状语从句。

(2)such as catastrophic loss from an earthquake 是句中主语any extraordinary items 的同位语。

3. Operating results summarized by the income statement will be reflected in the owners’ equity on the balance sheet at the end of that period.

过去分词短语summarized by the income statement修饰句中主语operating results。

READING MATERIAL

WORKING CAPITAL AND SHORT - TERM LIQUIDITY ANALYSIS

A company’s short-term liquidity (短期偿债能力) refers to its ability to meet short-term obligations. The working capital (菅运资本),which is the difference between a firm’s current assets and current liabilities,is a significant figure, because it represents the net current capital with which the firm conducts its operations. Insufficient working capital may prevent a firm from meeting its debts on time. Sometimes, when a company borrows using long-term notes or bonds, the lender requires the borrower to maintain a stipulated amount of working capital.

In analyzing a company’s short-term liquidity,we can calculate various working capital ratios. These ratios include:

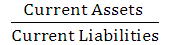

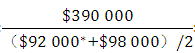

Current Ratio(流动比率)=

This ratio is a measure of the firm’s ability to meet its current obligations on time and to have funds readily available for current operations. For many years,some short-term creditors have relied on a rule of thumb (拇指,法则,经验规律)that the current ratio for industrial companies should exceed 200%.

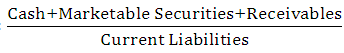

Sometimes analysts calculate the ratio between the liquid or“quick”,current assets and the current liabilities. The quick ratio may give a better picture than the current ratio of a company‘s ability to meet current debts. When taken together with the current ratio,it gives the analyst an idea of the influence of the inventory figure in the company’s working capital position.

Quick Ratio(速动比率)=

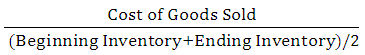

The inventory turnover ratio measures the average rate of speed inventories move through and out of company. Inventory turnover is computed as:

Inventory Turnover(存货周转率)=

Of course,a low inventory turnover can result from an overextended inventory position or from inadequate sales volume. For this reason,appraisal of inventory should be accompanied by scrutiny of the quick ratio and analysis of trends in both inventory and sales to find out what has occurred. Inventory turnover figures vary considerably from industry to industry, and analysts frequently compare a firm’s experience with industry averages.

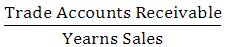

The average collection period is used to determine the number of days it takes,on average to collect accounts (and notes) receivables. It is calculated as:

Average Collection Period(平均收账期)=

A rough rule of thumb sometimes used by credit agencies is that the average collection period should not exceed 1. 5 times the net credit period. With the figure in Douglas Company’s balance sheet on January 31,20X0 and the income statement for the month of January, 20X0 we get:

(1)Working capital= $ 202 000 — $ 79 000= $ 123 000

(2)Current ratio= = 2. 56 or 256%

= 2. 56 or 256%

(3)Quick ratio = =1.25 or 125%

=1.25 or 125%

(4) Inventory turnover= =4.11 times

=4.11 times

* the supposed amount of beginning inventory.

(5) Average collection period= X 365=24. 82 days

X 365=24. 82 days

LESSON FIVE LEDGER ACCOUNTS

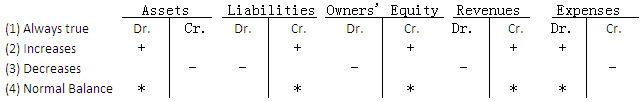

The necessary data for preparing the balance sheet and income statement are accumulated in five major categories of ledger accounts :assets,liabilities, owners,equity, revenues and expenses. An account is simply a record of changes (increases and decreases) and balances in the value of a specific item. The rules of debit and credit applied to each of the five categories of accounts are:

(1)The terms debit and credit are used to describe the left-hand and right-hand sides of any "two-column” account.

(2)Increases in asset and expense accounts are debit entries, while increases in liability, ownersy’ equity and revenue accounts are credit entries.

(3)Decreases are logically recorded on the side opposite increases.

(4)The normal balance of any account appears on the side for recording increases.

These rules can be illustrated graphically as follows:

Under the double-entry bookkeeping system, the twofold effect of every transaction is recorded. Each business transaction should be analyzed into equal debits and credits. Usually the Bookkeeper is able to determine the appropriate accounts to be debited and credited by examining the source documents. For example, a scrutiny of the check stub from the rent payment would reveal the need for debiting Rent Expense and crediting cash.

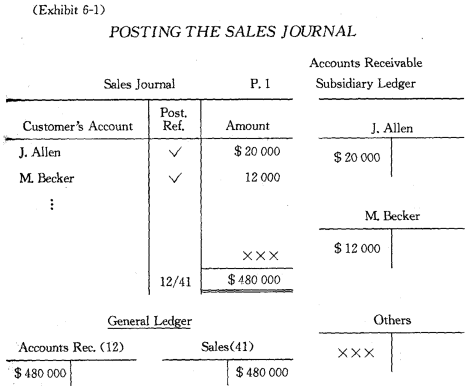

As a means of formal recording, we shall use a set of journals, or records of original entry, in which business transactions are analyzed in terms of debits and credits and recorded in chronological order. After transactions have been journalized, the debits and credits in each journal entry are transcribed to the appropriate ledger accounts. This transcribing process is called posting to the ledger.

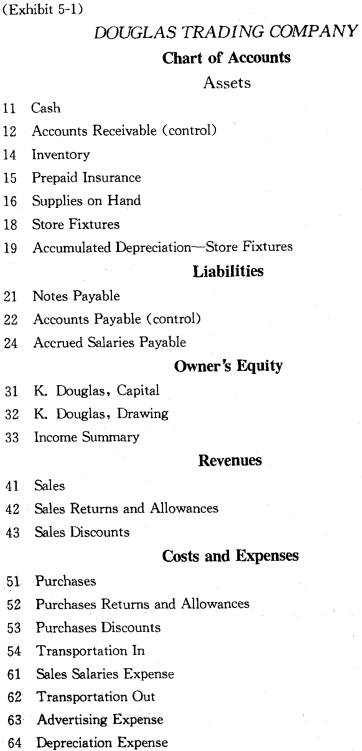

To facilitate the analysis of transactions and the formulation of journal entries, a chart of accounts is usually prepared. It is a listing of the titles and numbers of all accounts found in the general ledger, The account titles should be grouped by and in order of,the five major sections of the general ledger (assets, liabilities,owners’ equity, revenues,expenses). Exhibit 5-1 shows a chart of accounts for Douglas Trading Company.

As we see in the above chart of accounts, a single control account for accounts receivable and another for accounts payable are used in the general ledger. A large number of individual customer and creditor accounts will be maintained in separate subsidiary ledgers. Under this approach,the general ledger is kept to a more manageable size and there is a detailed record of transactions with individual customers and creditors respectively. Examples of other general ledger accounts that often have subsidiary ledgers are Inventory (in a perpetual inventory system), Equipment, and Buildings.

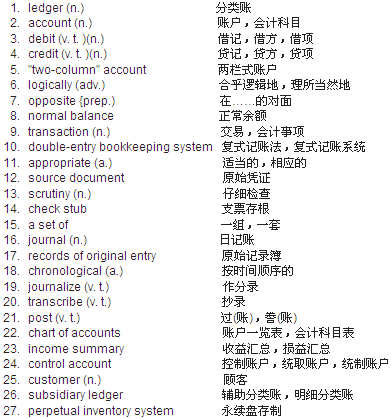

New Words, Phrases and Special Terms

Notes to the Text

1.Increases in asset and expense accounts are debit entries,while increases in liability, owners’equity and revenue accounts are credit entries.

用连词while连接的并列句。

2.As a means of formal recording,we shall use a set of journals,or records of original entry,in which business transactions are analyzed in terms of debits and credits and recorded in chronological order.

(1)介词短语As a means of…修饰全句。

(2)or records of original entry 是a set of journals 的同位语。

(3)全句包含一个非限制性定语从句in which business transactions are analyzed…and recorded…,修饰a set of journals.从句中,用and连接它的两个谓语are analyzed…and (are) recorded …。

READING MATERIAL

THE FORMS OF ACCOUNTS

The account is seen in several forms. In a manually maintained bookkeeping system, the “two-column” account form is often used.

(Account Title)Account No.

|

Date |

Description |

Post. Ref. |

Amount |

Date |

Description |

Post. Ref. |

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

Making an entry in an account consists of recording an amount in the “Amount" column to represent either an increase or a decrease in the account. Spaces are also provided for other types of information-the date of an entry, some memoranda explaining a particular entry, and a posting reference(过账备查,过账记号)(indicated by Post. Ref. ). The posting reference column is used for noting the records from which entries into this account may have been taken.

Another popular form is the “running balance” or“three-column" account(逐笔结计余额式或三栏式账户).

The running balance account contains all the information shown in the two-column account but also provides a balance after each transaction so that the account balance for any date during the period can be easily perceived. If the account balance becomes abnormal (for example,if we overdrew透支our bank balance,the balance of the cash account would be abnormal),it should be placed in parentheses.

(Account Title)Account No.

|

Date |

Description |

Post. Ref. |

Date |

Credit |

Balance (Dr. or Cr.) |

|

|

|

|

|

|

|

|

|

LESSON SIX JOURNALS

An accounting journal may be one of a group of special journals or it may be a general journal. The general journal is a relatively simple record in which any type of business transaction can be recorded. In contrast to the general journal, a special journal is designed to record a specific type of frequently occurring business transaction. Most firms use, in addition to a general journal,at least the following special journals:

Special Journal Specific Transactions to be Recorded

Sales Journal Sales on credit term

Cash Receipts Journal Receipts of cash, including cash sales

Invoice Register Purchases of merchandise and other items

(Purchases Journal) (supplies, fixed assets, etc.)on credit terms

Cash Disbursements Payments of cash,including cash purchases

Journal

When special journals are used, only those transactions that do not occur often enough to warrant entry in a special journal are recorded in the general journal.

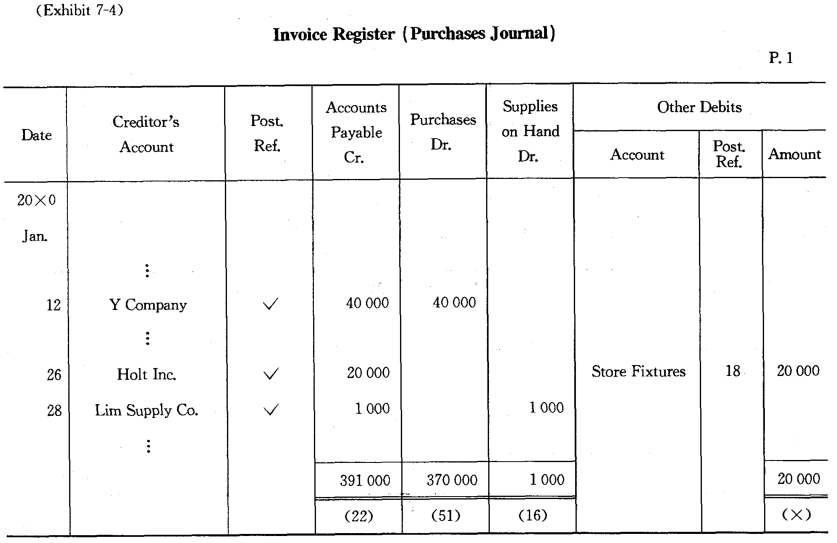

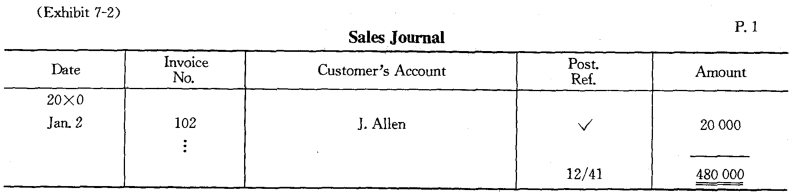

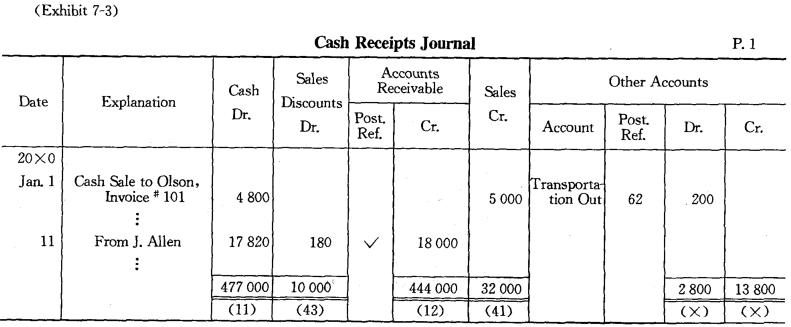

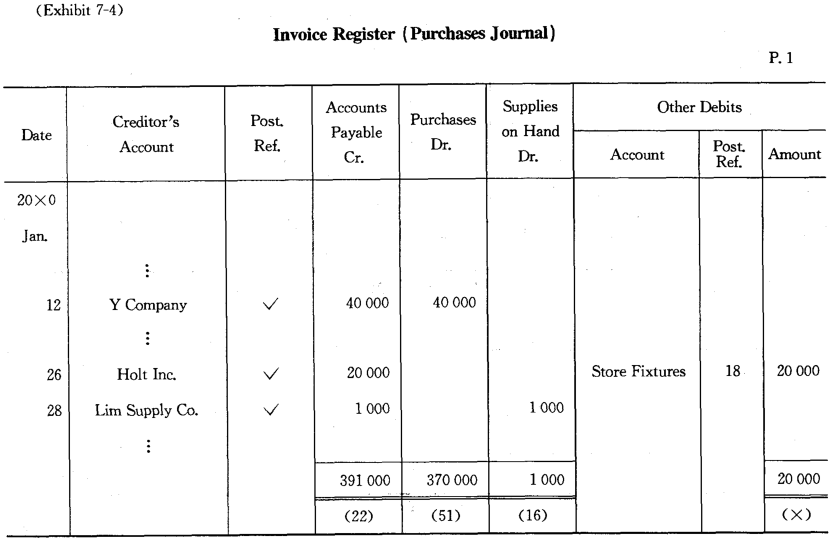

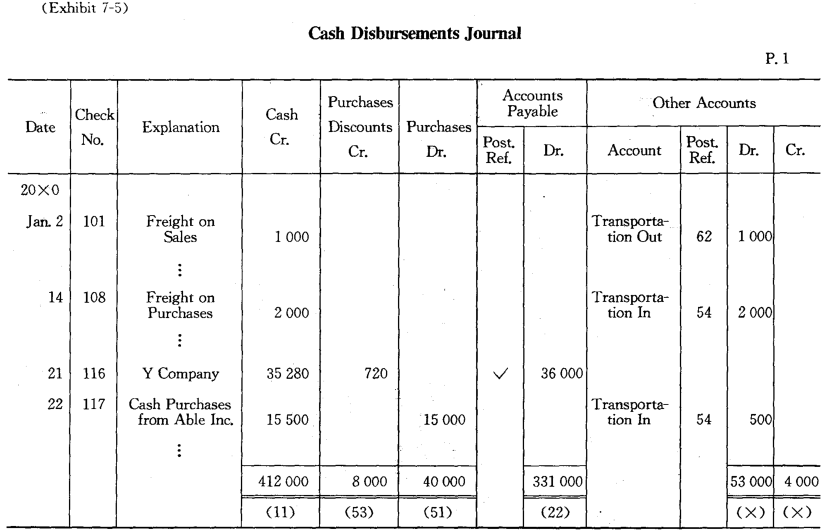

A major advantage of special journals is that their use permits a division of labor. Nevertheless,the most significant advantage of using special journals is the time saved in posting from the journals to the ledger. When a general journal is used,each entry must be posted separately to the general ledger. The tabular arrangement of i special journals,however, often permits all entries to a given account to be added and posted as a single aggregate posting. The I more the transactions that are involved,, the greater the savings in I posting time. This advantage will be apparent in the illustration given below:

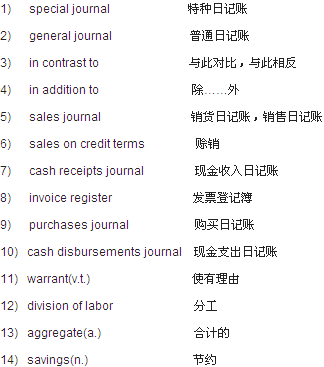

New Words, Phrases and Special Terms

Notes to the Text

1.When special journals are used, only those transactions that do not occur often enough to warrant entry in a special journal are recorded in the general journal.

(1)全句包含一个用连词when引导的时间状语从句。

(2)定语从句that do not occur…journal 修饰主句主语those transactions. 关系代词that在从句中作主语。

(3)定语从句内,often enough + to warrant ...修饰从句的谓语动词do not occur。句子内带有enough(或too)这样的副词时,常接用不定式作其状语,这里的意思是:“要值得使用特种日记账来记录,那么,那些交易发生得还不够经常。”译成汉语时,通常写成:“那些交易发生得不够经常,因而不值得使用特种日记账来记录。”(参阅参考译文)

2. the more the transactions that are involved, the greater the savings in posting time.

(1) The more…the greater…(the+比较级形容词……the+比较级形容词……)表示对比的两件事成正比例地增减,这种结构比较特殊,可以把前面一段看作状语从句,修饰后面的整个主句。

(2)对比的两件事是the transactions that are involved 和the savings in posting time,在结构上是对等的,都是“用作主语的名词+定语”。定语从句that are involved 修饰the transactions,介词短语in posting time 修饰the savings。

READING MATERIAL

STEPS IN THE ACCOUNTING CYCLE

The accounting cycle (会计循环)can be divided into the following steps:

- Analyze transactions from source documents.

- Record in journals.

- Post to general (and subsidiary) ledger accounts.

- Adjust the general ledger accounts.

- Prepare financial statements.

- Close temporary accounts (暂时性用户).

The various steps in the accounting cycle do not occur with equal frequency (频繁程度). Usually, analyzing, journalizing and posting (steps 1—3) take place during each operating period,whereas accounts are adjusted and statements are prepared only when management requires financial statements-usually at monthly or quarterly intervals, but at least annually. Temporary accounts are customarily closed only at the end of the accounting year.

Business firms whose accounting year ends on December 31 are said to be on a calendar-year(日历年度) basis. Many firms prefer to have their accounting year coincide with their “natural” business year; thus the year ends when business is slow and inventory quantities are small and easier to count. At this time, end-of-year accounting procedures are most efficiently accomplished. An accounting year ending with a month other than December is called a fiscal year (财务年度).

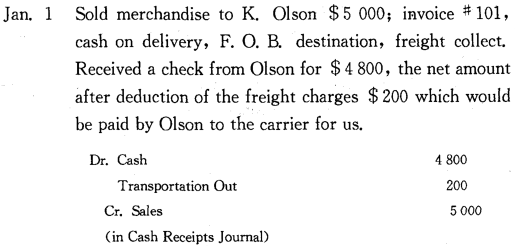

LESSON SEVEN AN ILLUSTRATION

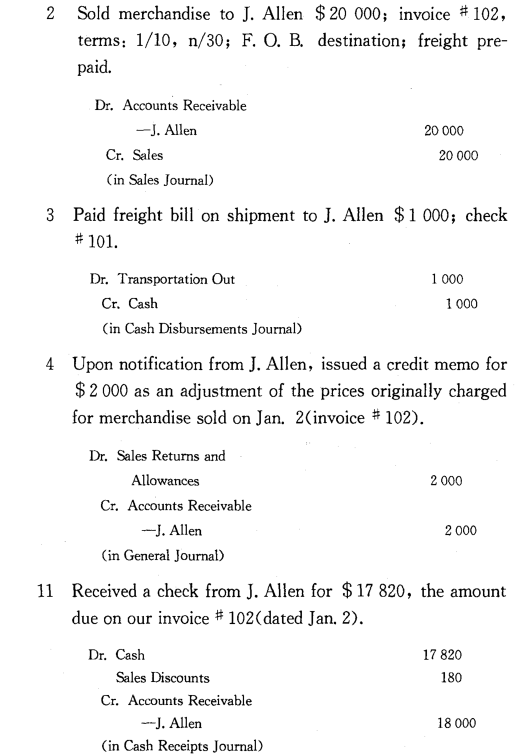

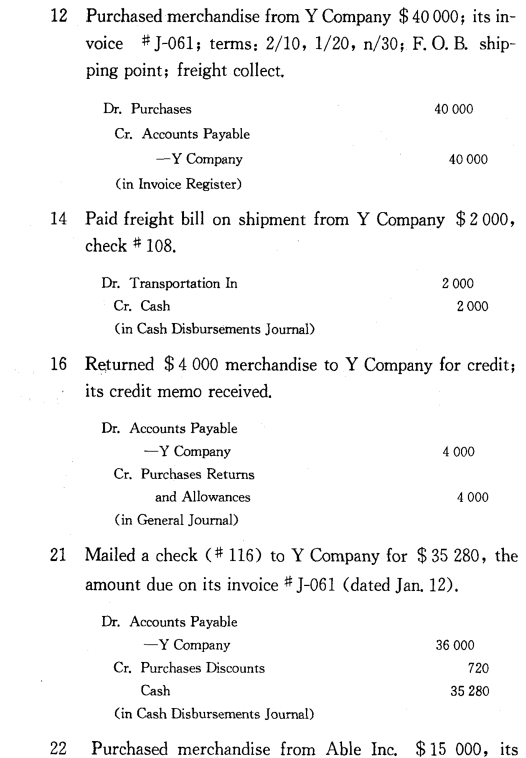

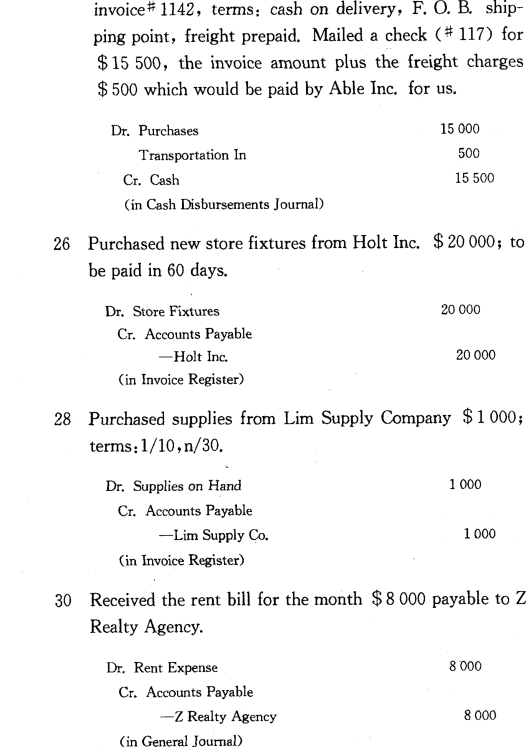

We shall list a few transactions to demonstrate how they are recorded in the several journals mentioned in Lesson Six. Pay attention to the credit terms involved in respective transactions. Note that cash discounts are calculated on the billed price of merchandise retained in a purchase or sale-not on amounts representing returns and allowances or transportation costs. As for transportation terms, the terms “prepaid” and “collect” designate the party expected to remit to the freight company. The party who is to bear transportation costs is designated by the terms “F. O. B. destination” (seller) and “F. 0. B. shipping point”(buyer).

20X0

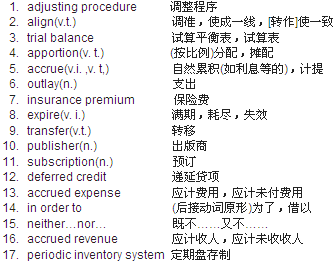

New Words, Phrases and Special Terms

Notes to the Text

1.We shall list a few transactions to demonstrate how they are recorded in the several journals mentioned in Lesson Six.

(1)不定式复杂结构to demonstrate…用作表示目的的状语,修饰shall list a few transactions。

(2)由连接副词how引导的从句how they are recorded…是to demonstrate 的宾语。

(3)过去分词短语mentioned…修饰the several journals。

2. The party who is to bear transportation costs is designated by the terms "F. O. B. destination"(seller) and "F. O. R shipping point"(buyer).

(1)定语从句who is to…costs修饰全句主语the party。关系代词who在从句中作主语,故用主格。

(2)定语从句中的谓语is to bear…是"be+不定式” 结构,表示预先安排的即将发生的情况。

READING MATERIAL

STEPS IN A MERCHANDISE TRANSACTION

Whenever a transaction is initiated for the purchase or sale of merchandise, the buyer and the seller should agree on the price of the merchandise,the terms of payment, and which party is to bear the cost of transportation Most large businesses fill out a purchase order when ordering merchandise. A typical sequence of events is as follows:

(1)A request for a purchase,called a purchase requisition(请购单), is initiated by the person in charge of merchandise stock(存货)records whenever certain items are needed or when quantities of certain merchandise fall below established reorder points (再定货点).The requisition is forwarded to the purchasing department (购货部门).

(2)The purchasing department then prepares a purchase order(定货单)after consulting price list(价目表),quotations(行情表),or suppliers’ catalogs(供应商商品目录).The purchase order, addressed to the selected vendor (卖主),indicates the quantity, description, and price of the merchandise ordered. It may also indicate expected terms of payment and arrangements for transportation, including payment of freight costs.

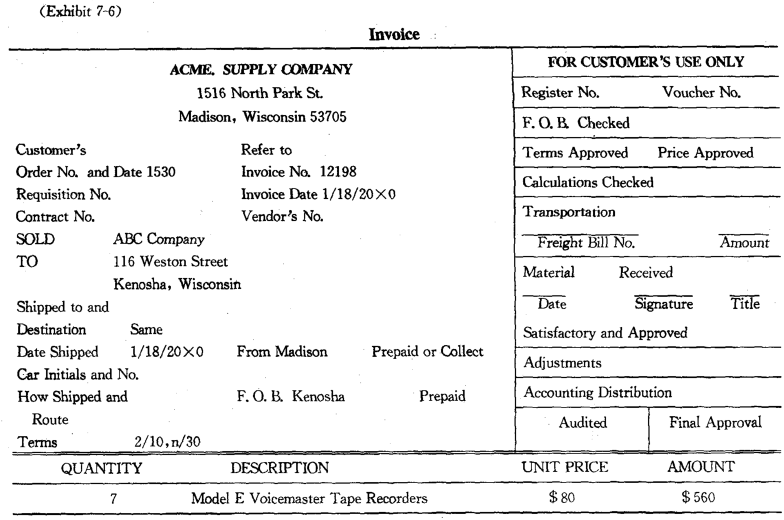

(3)After receiving the purchase order, the seller, upon shipment, makes out an invoice, which is forwarded to the purchaser. The invoice, called a sales invoice (销货发票)by the seller and a purchase invoice (购货发票) by the buyer, defines the terms of the transaction. A sample(样本)of invoice is shown in Exhibit 7-6.

(4)Upon receiving the shipment of merchandise,the purchaser’s (收货部门)counts and inspects the items in the shipment and makes out a receiving report(收货报告)detailing the quantities received.

(5)Before approving the invoice for payment, either the purchasing department or the accounts payable department compares copies of the purchase order, invoice, and receiving report to determine that quantities, descriptions,and prices are in agreement.

Although all the above papers-purchase requisition, purchase order, receiving report,and invoice-are source documents, only the invoice provides the basis for an entry in the purchaser’s accounting records. The other three documents are merely supporting documents. The purchaser makes no entries until the invoice is approved for payment. The seller enters the transaction in the records when the invoice is prepared, usually upon shipment of the merchandise.

LESSON EIGHT ADJUSTING PROCEDURES

Many of the business transactions affect the net income of more than one period. Clearly, if the income statement is to portray a realistic net income figure based upon accrual accounting, all revenues earned during the period and all expenses incurred must be shown. Therefore, it is often necessary to adjust some account balances at the end of each accounting period to achieve a proper matching of costs and expenses with revenue. The adjusting step occurs after the journals have been posted and a trial balance of ledger accounts has been taken,but before financial statements are prepared.

Adjusting entries made to align revenue and expense with the appropriate periods consist of four types:

- Apportioning recorded costs to periods benefited.

- Apportioning recorded revenue to periods in which it is earned.

- Accruing unrecorded expenses.

- Accruing unrecorded revenue.

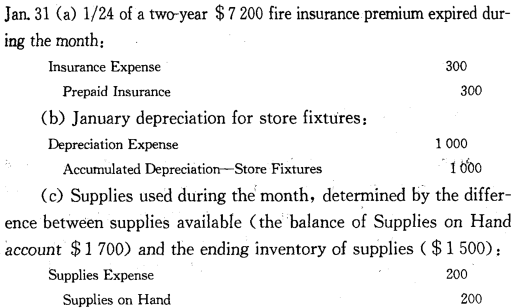

Apportioning Recorded Costs Many business outlays (such as purchases of buildings,equipment,and supplies and payments of insurance premiums covering a period of years) are made to benefit a number of accounting periods. At the end of each accounting period, the estimated portion of the outlay that has expired during the period or that has benefited the period must be transferred from an asset account to an expense account. In our Douglas Company illustration, these adjusting entries would be:

Apportioning Recorded Revenue Sometimes a business (for example, a monthly magazine publisher) receives fees for services before service is rendered. The unearned revenue (here, a three- year subscription for $ 360) shows the obligation for performing future service and is often referred to as a deferred credit. Each month, 1/36 of the publisher’s obligation is fulfilled when magazines are supplied to the subscribers. We would transfer $ 10 from the liability account to a revenue account at the end of each month.

Unearned Subscription Revenue 10

Subscription Revenue 10

Accruing Unrecorded Expenses Often a business will use certain services before paying for them. An obligation to pay for such services as salaries,utilities and taxes may build up or accrue over a period of time. It is necessary to make adjusting entries for such accrued expenses in order to reflect the proper cost in the period when the benefit was received. In our Douglas Company illustration, the adjusting entry for the salaries accrued is as follows:

Jan. 31 (d) To reflect the salaries to employees on services rendered but not paid on Jan. 31:

Sales Salaries Expense 3 000

Office Salaries Expense 1 000

Accrued Salaries Payable 4 000

Accruing Unrecorded Revenue Sometimes a company provides services during a period that are neither billed nor paid for by the end of the period. Yet the value of these services represents revenue earned by the firm and should be reflected in the firm’s income statement. Such accumulated revenue is often termed accrued revenue. The adjusting entry would be as follows:

Accrued Revenue XXX

Service Fees Earned XXX

Merchandise Inventory Adjustment Under a periodic inventory system, a firm determines its merchandise inventory only at the end of each accounting period and adjusts its records through the Income Summary account. For our Douglas Company example, the following adjusting entries are made.

New Words, Phrases and Special Terms

Notes to the Text

1.Clearly if the income statement is to portray a realistic net income figure based upon accrual accounting,all revenues earned during the period and all expenses incurred must be shown.

(1)全句包含一个用连词if引导的条件状语从句。

(2)英语中,副词如clearly,obviously等,常用在句首。这里,dearly=it is clear that.

2. The adjusting step occurs after the journals have been posted and a trial balance of ledger accounts has been taken,but before financial statements are prepared.

全句包含用连词but连接的两个时间状语从句:after和before…。

3. At the end of each accounting period, the estimated portion of the outlay that has expired during the period or that has benefited the period must be transferred from an asset account to an expense account.

用连词or连接的两个定语从句都用来修饰全句主语the estimated portion of the outlay。关系代词that在这两个定语从句中都用主语。

4. It is necessary to make adjusting entries for such accrued expenses in order to reflect the proper cost in the period when the benefit was received

(1)引词it作全句的形式主语,真正主语是不定式短语to make…expenses。

(2)不定式复杂结构in order to reflect…用作修饰全句的状语(表示目的)。

(3)这一不定式复杂结构中,包含一个修饰the period的定语从句。它是用关系副词when引导的。

5. Sometimes a company provides services during a period that are neither billed nor paid for by the end of the period,

(1)定语从句that are…修饰全句谓语动词的宾语services。关系代词that是从句的主语。

(2)从句中两个并列的谓语动词are billed和(are) paid for,用连词neither…nor连接起来。

READING MATERIAL

ACCRUAL BASIS ACCOUNTING AND CASH BASIS ACCOUNTING

In firms that employ an accrual basis (权责发生制)accounting system revenue is recognized when earned rather than when cash is collected and expenses are recognized when goods and services are used rather than when they are paid for. The expenses incurred are matched with the relative revenue earned in order to determine a meaningful net income figure for each accounting period. Yet, certain businesses, principally service enterprises(服务业企业),often use a cash basis (收付实现制)mode of accountinng. In contrast to accrual basis accounting, the cash basis system does recognize revenues when money is received and expenses when money is paid .Cash basis accounting is used primarily because it can provide certain income tax benefits and because it is simple. However, cash basis financial statements may distort the portrayal of financial position and operating results of a business because the revenue and expenses for determining net income do not depend on the time period when cash is actually received or expended. Consequently, most business firms use the accrual basis of accounting.

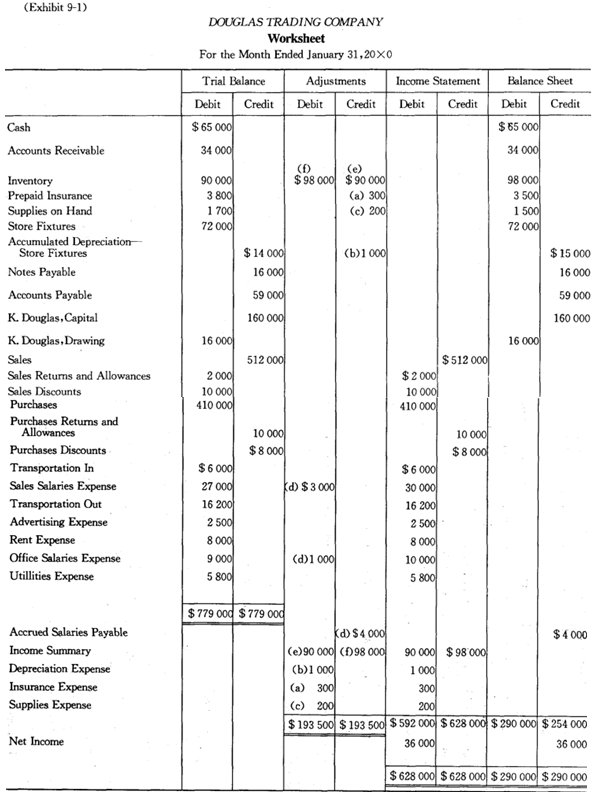

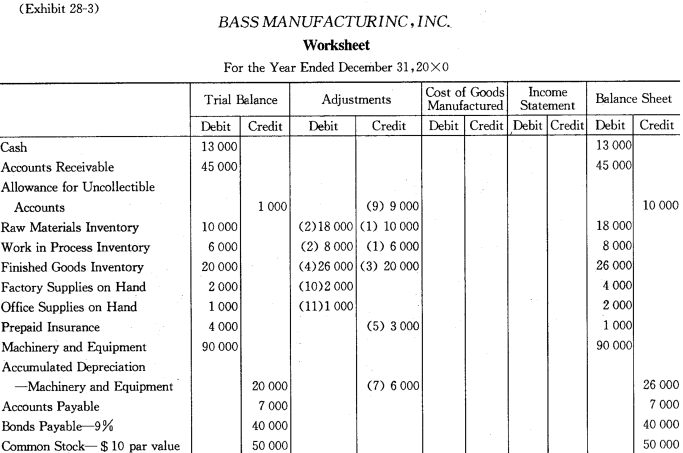

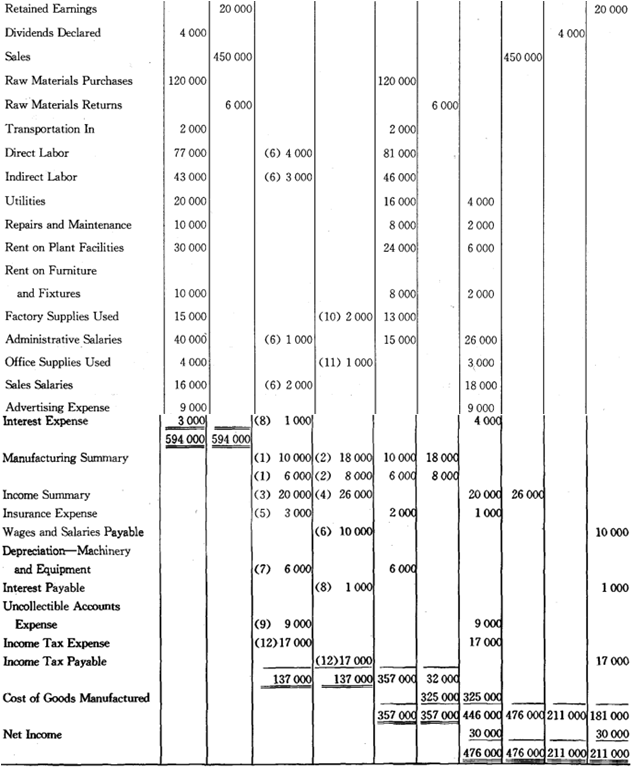

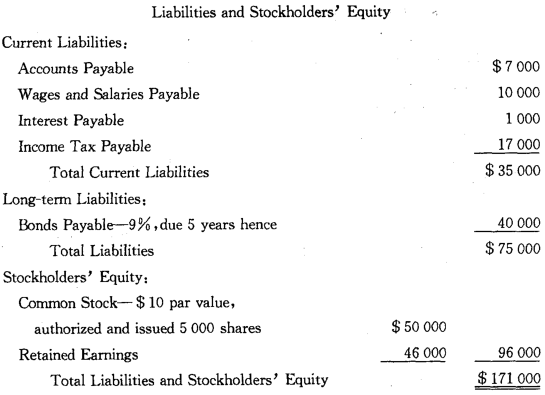

LESSON NINE A WORKSHEET

Once the appropriate adjusting entries have been made and posted to the ledger accounts, an income statement and a balance sheet may be prepared directly from the account balances. In actual practice,however, many accountants find that drawing up a worksheet first facilitates the preparation of the statements. The worksheet presented is prepared after all transactions for January have been recorded and posted to the accounts of Douglas Trading Company. A trial balance is taken from the ledger accounts and listed in the first two columns of the worksheet. Adjustments enter on the worksheet directly. Then, the adjusted balances are extended into the income statement and balance sheet columns of the worksheet;they provide the data for formal financial statements.

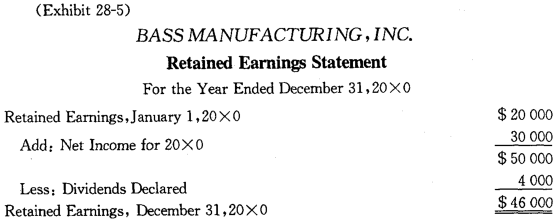

Once the worksheet is completed, preparing the formal financial statements for the period is a simple matter. The income statement for January and the balance sheet on Jan. 31 prepared from the foregoing worksheet have already been presented in Lesson Four and Lesson Two.

A formal set of financial statements frequently includes a statement of owners’ equity (in the case of single proprietorships and partnerships). As for corporations,a statement of retained earnings would be included. The statement of owners’ equity simply lists the beginning balance,additions,deductions and ending balance of owners’ equity for the accounting period. When capital contributions have been made during the period,we cannot determine from the worksheet alone the beginning balance of owners’ capital and amounts of capital contributions during a period. Consequently, in preparing a statement of owners’ equity, we must examine the owners’ capital accounts in the general ledger. The statement of owner’s equity of Douglas Trading Company for the month of January has been illustrated in the Reading Material of Lesson Three.

When interim (monthly or quarterly) financial statements are being prepared, usually adjustments are made only on the worksheet and will not be recorded in the journal and posted to the ledger accounts. At the close of the calendar or fiscal year, however,the necessary adjusting entries must be recorded in the general journal and posted to the ledger accounts in order to accomplish the proper closing procedures.

New Words, Phrases and Special Terms

Notes to the Text

1. In actual practice, however,many accountants find that drawing up a worksheet first facilitates the preparation of the statements.

(1)句首的介词短语in actual practice修饰全句谓语find that…。

(2)全句谓语动词find的宾语是用连词that引导的从句。

(3)宾语从句中的主语是动名词短语drawing up a worksheet first。

2. Then, the adjusted balances are extended into the income statement and balance sheet columns of the worksheet; they provide the data for formal financial statements.

分号“;”可以用来把两个意义上有一定联系的句子连接在一起。

3. When interim financial statements are being prepared,usually adjustments are made only on the worksheet and will not be recorded in the journal and posted to the ledger accounts.

(1)全句包含一个用连词when引导的时间状语从句。从句中的谓语动词are being prepared系现在进行时态的被动语态形式。现在进行时态有时用来代替一般现在时态,表示经常性的动作或情况。

(2)主句中,第一个连词and连接并列的谓语are made…和will not be recorded…and posted…,第二个连词and 是连接recorded 和posted的。亦即,recorded 与posted并列,are made 和will not be recorded…and posted…并列。

READING MATERIAL

THE TRIAL BALANCE

The trial balance is a list of the account titles in the ledger with their respective debit and credit balances. It is prepared at the close of an accounting period after transactions have been recorded. It should be dated. The two main reasons for preparing a trial balance are:

(1)to serve as an interim mechanical check (中间性的手工操作检查) to determine if the debits and credits in the general ledger are equal.

(2) to show all general ledger account balances on one concise record. This is often convenient when preparing financial statements.

It is always reassuring, of course, when a trial balance does balance. Even when a trial balance is in balance, however, there still may be errors in the accounting records. Among these errors are:

- failing to record or enter a particular transaction.

- entering a transaction more than once.

- entering one or more amounts in the wrong accounts.

- making a compensating error that exactly offsets the effect of another error.

Thus, a balanced trial balance simply proves that, as recorded, the debits equal the credits. When a trial balance is out of balance, it is necessary to search for errors.

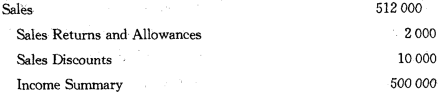

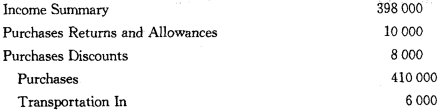

LESSON TEN CLOSING PROCEDURES

Revenue and expense accounts are temporary accounts used to accumulate data related to a specific accounting year. These temporary accounts are maintained to facilitate preparation of the income statement. At the end of each accounting year,these temporary accounts will be closed. Their balances are transferred to the Income Summary account. Here we use Douglas Company’s January data for illustration, though actually temporary accounts are not closed monthly.

(g)To close Sales and related accounts and transfer net sales to the Income Summary account

(h)To close Purchases and related accounts and transfer net purchases cost to the Income Summary account.

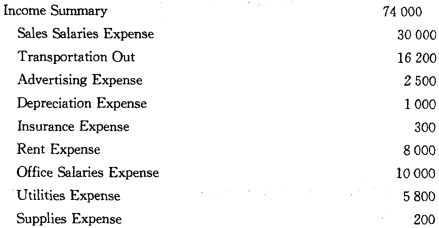

(i) To close operating expense accounts to the Income Summary account.

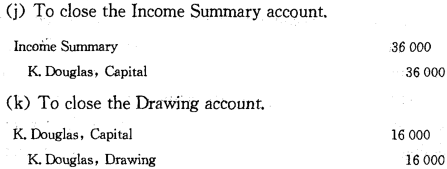

At this point, the balance of the Income Summary is a credit equal to the net income of $ 36 000. The closing procedure is completed by closing the Income Summary and K. Douglas, Drawing accounts to the K. Douglas, Capital account.

In the case of a corporation, the Income Summary account will be closed to the Retained Earnings account, which is kept separately from the Capital Stock account.

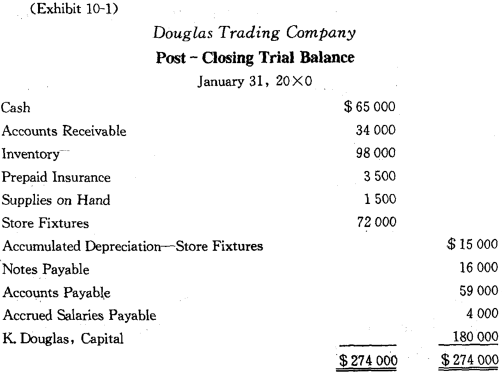

A post-closing trial balance is usually taken after the closing process. This procedure assures that an equality of debits and credits has been maintained throughout the adjusting and closing process.

In practice, it is desirable to make reversing entries at the beginning of next accounting period to eliminate the accrued amounts of the respective expense and revenue items. The method of reversing adjustments made for accruals is an expedient to permit normal recording of subsequent payments or receipts. Since there is no accrued revenue item in our Douglas Company illustration, the reversing entry that would be made is only for the accrued salaries.

Feb. 1 Accrued Salaries Payable 4 000

Sales Salaries Expense 3 000

Office Salaries Expense 1 000

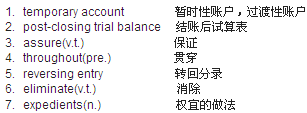

New Words, Phrases and Special Terms

Notes to the Text

1. In the case of a corporation,the Income Summary account will be closed to the Retained Earnings account, which is kept separately from the Capital Stock account.

(1)介词短语In the case of a corporation 修饰全句。

(2)修饰the Retained Earnings account 的定语从句which is kept…是非限制性的。

READING MATERIAL

AUTOMATED DATA PROCESSING

We are already familiar with the manner in which accounting data processing is accomplished in a manual recordkeeping system. Source documents are prepared and entered manually;classification and sorting (分类整理)are accomplished through journals and ledgers;computations are often done manually; and storage (存储)is achieved by manual filing (手工归档).Storage is in the form of ledger accounts, subsidiary ledgers and various files. Retrieval (追溯) and summarization are entirely manual. Now we wish to examine the points in the accounting process where machines can be used to save labor.

The first way to speed processing and reduce workloads in manual processing is to introduce key-driven equipment (键盘式装置设备),such as adding machines (加法机),calculators (计算器)and bookkeeping machines (簿记机).Some of these devices afford only limited data storage during arithmetical calculations; so that practically all storage, retrieval and summarization of data must still be performed manually. Certain bookkeeping machines, however, have auxiliary equipment (辅助设备),such as punched card (穿孔卡)and paper tape output (纸带输出),that allows data to be stored for further processing.

An electronic data processing (EDP) system (电子数据处理系统)can handle many of the basic recordkeeping functions at incredible speeds. Moreover, much of the processing is continuous;because of the logic(逻辑判断的)or decision-making, capabilities of the computer, human intervention is minimized. Detailed planning and complex programming (程序编制), however, are required initially to prepare for each phase of information processing.

An electronic data processing system contains the following elements:

- A central processing unit (CPU)(中央处理单元)often called the computer (电子计算机,电脑),which performs arithmetic, logic,storage of data while processing and control.

- Associated peripheral equipment (边缘设备)including data-preparation (数据准备),input (输人)and output (输出)devices.

- Personal and programs (程序)to provide instruction (指令)for the computer.

- Procedures to coordinate the preparation and processing of data and the reporting of results.

The computer and associated equipment are often referred to as the hardware (硬件)of the system, while the programs, written procedures and other documentation for the system are called software (软件).

The various systems of automated data processing (自动数据处理) can be very detailed and complex. Here, we only provide some of the basic concepts.

LESSON ELEVEN CASH CONTROL

In accounting, the term cash means paper money,coins, checks,money orders and bank deposits—all items that are acceptable for deposit in a bank. IOUs, postdated checks (checks dated in the future) and uncollected customers’ checks returned by the bank stamped “NSF”(not sufficient funds) are not considered cash are normally classified as receivables. Notes sent to the bank for collection remain classified as notes receivable until notification of collection is received from the bank.

It is especially necessary to control the handling and recording of cash because it is so susceptible to misappropriation. An adequate system of internal control over cash would include the following features:

- Cash is handled separately from the recording of cash transactions.

- The work and responsibilities of cash handling and recording are divided in such a way that errors are readily disclosed and the possibility of irregularities is reduced.

- All cash receipts are deposited intact in the bank each day.

- All major disbursements are made by check and an imprest (fixed amount) fund is used for petty cash disbursements.

Observing the last two features permits a company to establish a double record of cash transactions. One record is generated by the firms' recordkeeping procedures and another is furnished by the bank. Control is provided by comparing the two records and accounting for any differences. This important procedure is called reconciling the bank statement with the book record of cash transactions or simply making a bank reconciliation.

Most business firms find it inconvenient and expensive to write checks for small expenditures. These expenditures are usually handled by establishing a petty cash fund. Control can be maintained by handling the fund on an imprest basis and by following certain well established procedures. Although expenditures from an imprest petty cash fund are made in currency and coin, the fund is established or increased by writing a check against the general bank account. After reviewing expenditures, replenishments are also accomplished by issuing checks. Therefore, in the final analysis, all expenditures are actually controlled by check.

Assume that A company has decided to establish a petty cash fund of $ 100. The entry reflecting establishment of the fund would be made in the cash disbursements journal:

Petty Cash 100

Cash in Bank 100

When the fund must be replenished, a check is drawn to petty cash in an amount that will bring the cash value of the fund back to $ 100. For example, assume that A company’s fund has been drawn down to $21 and that analysis of the $79 in bills and receipts reveals the following expenditures:Office Expense $ 45; Transportation In $ 26;Postage Expense $ 8. The entry of replenishment made in the cash disbursements journal would be:

Office Expense 45

Transportation In 26

Postage Expense 8

Cash in Bank 79

New Words, Phrases and Special Terms

Notes to the Text

1. Notes sent to the bank for collection remain classified as notes receivable until notification of collection is received from the bank.

(1)过去分词短语sent to the bank for collection修饰全句主语notes。

(2)remain是联系动词,过去分词短语classified as notes receivable 在主句中作表语。

(3)全句包含一个以连词until引导的时间状语从句。

2. It is especially necessary to control the handling and recording of cash because it is so susceptible to misappropriation.

(1)引词it是主句的形式主语,真正主语是不定式短语to control…cash。

(2)handling和recording是名词化动名词,介词短语of cash作其定语。

(3)全句包含一个由because引导的原因状语从句。

3. The work and responsibilities of cash handling and recording are divided in such a way that errors are readily disclosed and the possibility of irregularities is reduced.

(1)全句包含一个用such…that引导的结果状语从句,such修饰a way,that作连词。

(2)这一状语从句是并列结构,用连词and连接两个并列的分句。

4. Most business firms find it inconvenient and expensive to write checks for small expenditures.

句中谓语动词find的复合宾语中,作宾语的是不定式短语to write…, 补语则是形容词inconvenient and expensive,当用短语或从句作复合宾语中的宾语时,通常要用it代替它,而把这一短语或从句放到句子后部去。

READING MATERIAL

THE NATURE OF INTERNAL CONTROL

Internal control has been defined as:

The plan of organization and all of the coordinate methods and measures adopted within a business to safeguard its assets, check accuracy and reliability of its accounting data, promote operational efficiency(经营效率) and courage adherence to prescribed managerial policies (规定的管理方针).

Sometimes the organization, planning and procedures for safeguarding assets and the reliability of financial records are known as accounting controls(会计控制).The procedures and methods concerned mainly with operational efficiency and managerial policies are called administrative control(管理控制). Accountants should be conversant with both accounting controls and administrative controls. Indeed, many controls within these two categories are interrelated. Naturally, an accountant is more directly concerned with accounting controls.

The requirements for good internal accounting control are as follows:

(1) Competent personnel (称职的人员).

(2) Assignment of responsibility (分派责任).

(3)Division of work.

(4) Separation of accountability (会计责任)from custodianship (保管工作).

(5)Adequate records and equipment.

(6) Rotation of personnel.

(7)Internal auditing (内部审计).

(8)Physical protection (实物保护)of assets.

LESSON TWELVE A BANK RECONCILIATION

When a checking account is opened at a bank,the bank will submit monthly statements to the depositor showing the beginning cash balance, all additions and deductions for the month and the ending cash balance. In addition, the bank will return the paid checks for the month, together with “advice” slips indicating other charges and credits made to the account. We show a relatively simple bank statement below(see Exhibit 12-1).

Almost invariably,the ending balance on the bank statement differs from the balance in the company’s Cash in Bank account. Some reasons for differences are:

(1) Outstanding checks-checks written and deducted in arriving at the book balance,but not yet presented to the bank for payment

(2) Deposits not yet credited by the bank-deposits made near the end of the month, processed by the bank after the monthly statement has been prepared. They will appear on next month’s statement.

(3) Charges made by the bank but not yet reflected on the depositor's books-for example, service and collection charges, NSF checks, repayments of depositor’s bank loans.

(4) Credits made by the bank but not yet reflected on the depositor's books-collections of notes and drafts for the depositor by the bank.

(5) Accounting errors made either by the depositor or by the bank.

The bank reconciliation consists of a schedule to account for any of the above differences between the bank statement balance and the book balance. Ordinarily, neither balance represents the cash balance to be shown on the balance sheet. Both are reconciled to an adjusted balance, which will appear on the balance sheet and is the amount that could be withdrawn after all outstanding items have cleared.

A convenient reconciliation form is illustrated below:

If these final amounts do not agree, one should look carefully for reconciling items omitted from the schedule or for possible errors in recordkeeping.

The bank reconciliation is made not only to bring to light transactions that must be recorded,but also to detect errors or irregularities.

Before financial statements are prepared, adjusting entries should be made to bring the Cash account balance into agreement with the correct cash balance shown on the reconciliation. The entries would reflect the collection of the notes receivable and the related collection expenses,reclassification of the NSF (not sufficient funds) checks as accounts receivable and the bank service charge for the month. In our illustration:

New Words, Phrases and Special Terms

Notes to the Text

1. Both are reconciled to an adjusted balance, which will appear on the balance sheet and is the amount that could be withdrawn after all outstanding items have cleared.

(1) 全句包含一个非限制性的定语从句,which will appear…and is…, 修饰an adjusted balance。关系代词which在从句中作主语,从句的并列谓语用连词and连接起来。

(2) 在并列谓语的后半段isthe amount that…中,又包含一个以关系代词that引导的定语从句,修饰the amount。

(3) 在这一定语从句中,还包含一个用连词after引导的时间状语从句。

2. The bank reconciliation is made not only to bring to light transactions that must be recorded but also to detect errors or irregularities.

(1) not only…but also…连接两个不定式结构。谓语动词is made系被动语态。这种被动结构的句型,实际上是把主动结构句型中复合宾语内的宾语变为主语,补语则保持不动而转换成的。

(2) 两个不定式结构中,第一个是复杂结构,其中包含一个修饰不定式to bring to light的宾语transactions的定语从句;第二个是简单结结构,即不定式短语。

READING MATERIAL

THE BANK STATEMENT

In Exhibit 12-1 we show a relatively simple bank statement. Most bank statements list checks paid and other debits in the left-hand section, deposits and other credits in the middle section and cumulative balances (累计余额)in the right-hand section. Code letters (代号字母)are used to identify charges and credits not related to paying checks or making deposits. A legend usually appears at the bottom of the statement explaining the code letters. Although such codes are not standardized from bank to bank,those normally used are easy to understand. In the statement illustrated, the codes used are as follows:

EC--Error correction. Identifies transcription, arithmetic, similar errors and corrections made by the bank.

LS--List of checks. Identifies the total of a batch of checks too numerous to list separately on the statement An adding machine tape listing the individual check amounts usually accompanies each batch of checks listed.

DM--Debit memo. Identifies collection charges, repayment of bank loans, and other special charges made by the bank against the depositor’s account.

SC--Service charge. Identifies the amount charged by the bank for servicing the account. The amount is normally based on the average balance maintained and the number of items processed during the month. Service charges are usually made on small accounts that are not otherwise profitable for the bank to handle.

OD--Overdraft. Indicates a negative or credit, balance in the account.

RT--Returned items. Indicates defective items such as postdated checks or checks without proper endorsement (背书)received from customers and deposited. Sometimes not sufficient fund (NSF) checks charged back to the account are identified with these letters in the statement. NSF checks may also be identified with the letters DM, explained earlier.

In the bank statement illustrated, we see that:

(1) On December 3, a NSF check $135. 40 charged back to the account is identified by the code letters RT.

(2) On December 4, the collection charge $0. 50 for a $ 200 note collected by the bank is identified by the code letters DM.

(3) On December 31,the service charge $5. 00 for the month is identified by the code letters SC.

LESSON THIRTEEN VOUCHER SYSTEM

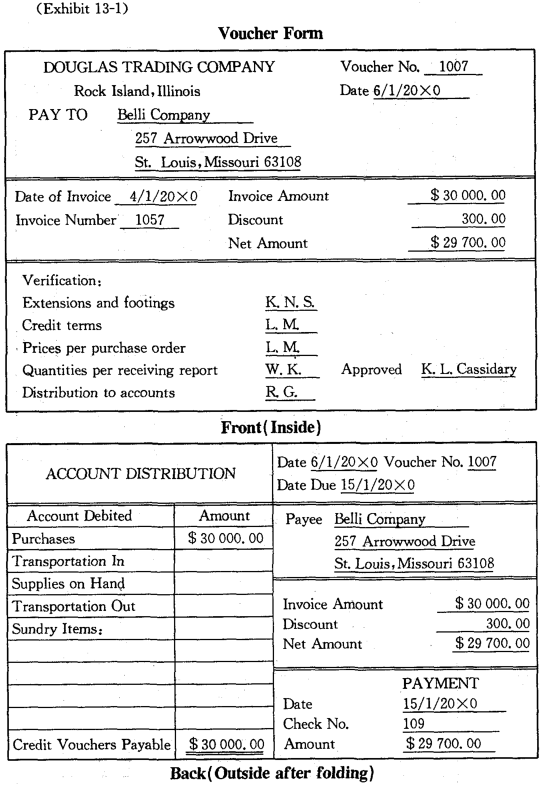

Many companies employ a method of controlling expenditures that is known as the voucher system. Under this system, a written authorization form, called a voucher, is initiated for every disbursement the firm makes. Before the designated responsible official approves the voucher for payment, several verification steps must be performed by different employees. These include the following (for the purchase of merchandise):

(1) Comparison of purchase order, invoice and receiving report for agreement of quantities, prices, type of goods, and credit terms.

(2) Verification of extensions and footings on invoice.

(3) Approval of account distribution (items to be debited).

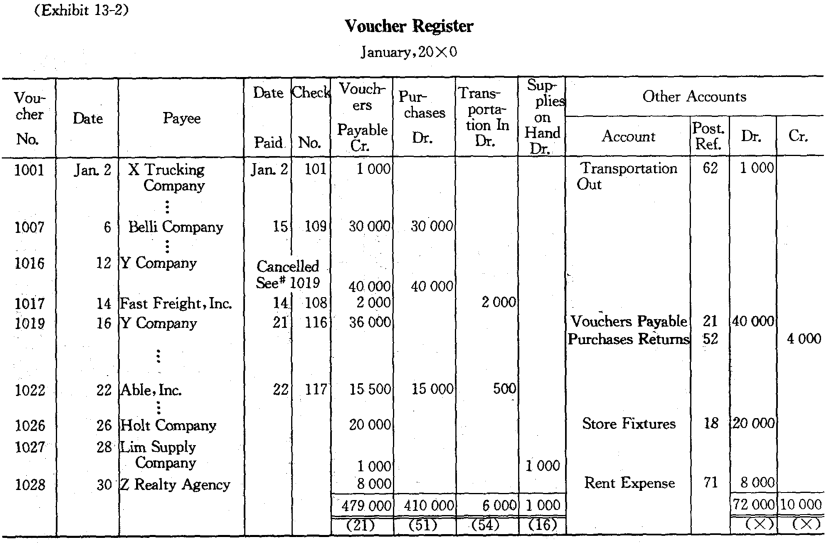

A voucher form is illustrated in Exhibit 13-1. The original copies of the purchase order, invoice and receiving report should be attached to the voucher. The voucher is then recorded in a book of original entry called the voucher register, which replaces the purchases journal (invoice register) we illustrate in Lesson Seven. A simple form of voucher register is provided in Exhibit 13-2. The entries recorded are from the same transactions given in Lesson Seven (with voucher # 1007 added in).

Note that:

(1) Since all expenditures are recorded in the voucher register whether the transaction is for cash or on account, the voucher register also substitutes for part of the cash disbursements journal illustrated in Lesson Seven.

(2) The most formal method of processing purchases returns and allowances under a voucher system is to cancel the original voucher and issue a new one for the lower amount (see vouchers # 1016 and # 1019).

Vouchers are entered in the voucher register in sequence. Then they are filed in an unpaid vouchers file in the order of required date of payment. In this way, cash discounts will not be missed and the company's credit standing will not be impaired.

On the due date, the voucher is removed from the unpaid file and forwarded to the firm's disbursing officer for final approval of payment. After signing the voucher, this officer has a check drawn and mailed to the payee. To safeguard against irregularities, the voucher should not be handled again by those who prepared it, and the underlying documents should be cancelled or perforated under the control of the disbursing officer before the voucher is returned to the accounting department.

After a voucher is paid,the check number and payment date are entered in the appropriate columns of the voucher register. Therefore,it is easy to determine the total unpaid(“open”)vouchers at any time by adding the items in the vouchers payable column for which there is no entry in the date paid and check number columns (see vouchers # 1026, # 1027, # 1028). This total should, of course, agree with the total of vouchers in the unpaid file and, at the end of the month, with the amount in the Vouchers Payable account.

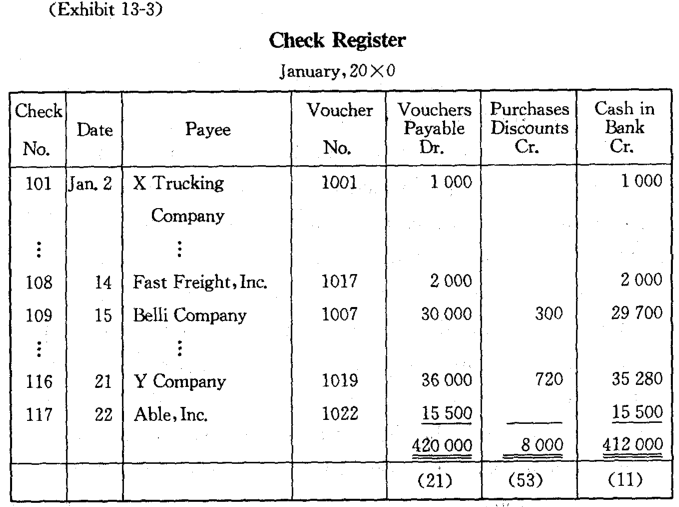

After these procedures have been followed, the payment is recorded in a book of original entry called the check register, which is used in place of a cash disbursements journal. Finally, the vouchers are filed in numerical sequence in a “paid” vouchers file.

New Words, Phrases and Special Terms

- authorization(n.) 授权

- voucher system 应付凭单制

- approve (v. t.) 批准

- verification(n.) 验证

- extension(n.) 算出或转来的金额

- footing(n.) 总计,总额

- purchase order 定货单,定购单

- receiving report 收货报告,收货单

- voucher register 应付凭单登记簿

- replace(v.t.) 取代

- sundry items 其他项目

- in sequence 按顺序,依次

- credit standing 信用地位,信誉

- perforate(v.t.) 穿孔于

- in place of 代替

Notes to the Text

1. The voucher is then recorded in a book of original entry called the voucher register, which replaces the purchases journal we illustrate in Lesson Seven.

(1)非限制性定语从句which replaces…修饰voucher register。

(2)在这一定语从句中,还包含一个修饰purchases journal 的定语从句(that)we illustrate…,关系代词that因在从句中作谓语动词illustrate的宾语,可省略。

2. Since all expenditures are recorded in the voucher register whether the transaction is for cash or on account,the voucher register also substitutes for part of the cash disbursements journal illustrated in Lesson Seven.

(1)全句包含一个用连词since引导的原因状语从句。

(2)在这一状语从句中,还包含一个用连词whether引导的条件状语从句。

(3)过去分词短语illustrated in…修饰the cash disbursements journal。

3. To safeguard against irregularities,the voucher should not be handled again by those who prepared it, and the underlying documents should be cancelled or perforated under the control of the disbursing officer before the voucher is returned to the accounting department.

(1) 用连词and连接的并列句。不定式短语to safeguard against irregularities表示目的,修饰全句。

(2) 在前一个并列分句中,包含一个修饰those的定语从句who prepared it。

(3) 在后一个并列分句中,包含一个由连词before引导的时间状语从句。

4. Therefore, it is easy to determine the total unpaid (“open”) vouchers at any time by adding the items in the Vouchers Payable column for which there is no entry in the date paid and check number columns.

(1) 全句中,it是形式主语,真正主语是不定式复杂结构to determine…。

(2) 在这一不定式复杂结构中,包含一个用介词引导的复杂结构by adding…,其中介词by的宾语是动名词复杂结构adding the items in…。

(3) 在这一动名词复杂结构中,包含一个修饰the items的定语从句。关系代词which在从句中作介词for的宾语。

READING MATERIAL

INTERNAL CONTROL IN OTHER AREAS

While it is vitally important to establish effective controls over the handling of and accounting for cash, control should also be provided for other activities of the firm. As in the case of cash, most controls are designed to separate the authorization of a transaction from the accounting for the transaction and the custody of any related assets. For example, the purchase and sale of securities normally require authorization by a company’s board of directors, and officers who have access (接近)to the securities should not have access to the accounting records. Other personnel should record security transactions and keep a record of security certificates by certificate number and amount.

Similarly, in the case of inventories, store(仓库) clerks handling inventory items should not have access to inventory records and should be separated from receiving departments and the processing of accounts payable. Similar controls should be exercised over receivables, long-term assets,payroll(工薪)transactions, and every other fact of business activity.

The subject of internal control is quite complex. Both external and internal auditors(审计员) devote a great deal of attention to internal control In analyzing an accounting system and preparing audits.

LESSON FOURTEEN LOSSES FROM UNCOLLECTIBLE ACCOUNTS

Few firms that extend credit to customers are immune to credit losses. Credit losses are regarded as operating expenses of the business and are debited to an appropriately titled account such as Uncollectible Accounts Expense. Other account titles frequently used are Loss from Uncollectible Accounts,Loss from Doubtful Accounts or Bad Debts Expense. Normally, the expense is classified as a selling expense on the income statement, although some companies may include it with administrative expenses.

There are two acceptable methods for recognizing losses from uncollectible accounts. One is called the direct write-off method. Under this method, bad accounts are charged to expense in the period when they are discovered to be uncollectible. The other method, which is preferable, is called the allowance method. This procedure not only matches credit losses with related revenue, but also results in an estimated realizable amount for accounts receivable in the balance sheet at the end of the period. The estimate is introduced into the accounts by means of an adjusting entry.

Estimates of credit losses are generally based on past experience, with due consideration given to forecasts of sales activity, economic conditions and planned changes in credit policy. The most commonly used calculations are related either to credit sales for the period or to the amount of accounts receivable at the close of the period.

Estimates Related to Credit Sales Suppose that credit sales for a period amount to $ 20 000 and that past experience indicates a loss of 1. 5%. The adjusting entry to provide for expected losses would be:

Dec. 31 Uncollectible Accounts Expense 300

Allowance for Uncollectible Accounts 300

Estimates Related to Accounts Receivable A company’s experience may show that at the end of a period a certain percentage of Accounts Receivable is likely to prove uncollectible. The credit balance in the allowance account should be equal to this amount. Therefore the company may simply derive the adjustment for uncollectibles as the amount needed to create the desired credit balance in the allowance account. Suppose that a particular company estimates uncollectibles as 5% of Accounts Receivable and that the Accounts Receivable balance at the end of an accounting period is $ 5 000. Therefore, the credit balance desired in the allowance account is $ 250. If the allowance account already has a residual credit balance of $ 40,the amount of the adjustment will be $ 210.

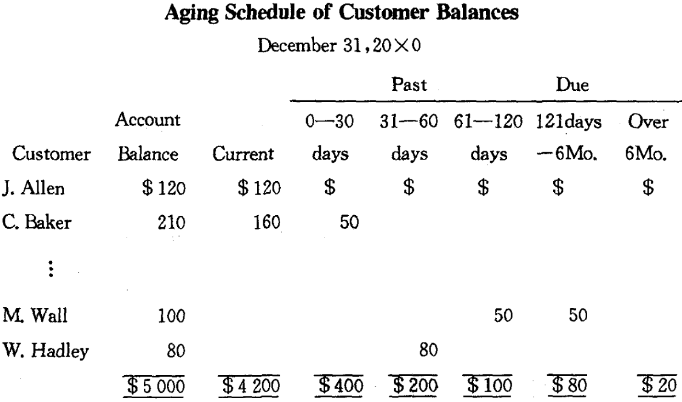

Instead of using a fixed percentage of the aggregate customer’s balances, some companies will determine the amount needed in the allowance account after analyzing the age structure of the account balances. In order to do this, they will prepare an aging schedule as follows:

Companies may analyze their bad accounts experience with the aged balances over time, and develop respective percentages of all strata that they think are likely to prove uncollectible. Applying the percentages to the totals in our aging schedule, we can calculate an allowance requirement of $ 156.

Again,if the allowance account had a residual credit balance of $ 40 the adjustment would be for $ 116.

Dec. 31 Uncollectible Accounts Expense 116

Allowance for Uncollectible Accounts 116

When a specific account is determined as uncollectible it would be written off through the allowance account.

Jan. 5 Allowance for Uncollectible Accounts 50

Accounts Receivable-M Wall 50

Note that this entry to write off an account has no effect on net income or on total assets. The expense was reflected, by means of the adjusting entry, in the period when the related revenue was recorded. Furthermore, since the Allowance for Uncollectible Accounts is deducted from Accounts Receivable in the balance sheet, the net realizable amount of Accounts Receivable is not changed by the write-off.

New Words, Phrases and Special Terms

Notes to the Text

1. Under this method, bad accounts are charged to expense in the period when they are discovered to be uncollectible.

用关系副词when引导的定语从句,修饰the period。

2. Estimates of credit losses are generally based on past experience, with due consideration given to forecasts of sales activity,economic conditions and planned changes in credit policy.

with引导的介词短语中,due consideration given to…是复合宾语(过去分词短语given to…作补语)。with后加复合宾语,常用作状语说明方式,有时则是说明附带的情况(如句中)。

3. Companies may analyze their bad accounts experience with the aged balances over time and develop respective percentages of all strata that they think are likely to prove uncollectible.

(1)全句中,用and连接的并列谓语的后一部分develop…percentages …中,包含一个修饰percentages (of all strata)的定语从句that…uncollectible,关系代词that在从句中作主语。

(2)这一定语从句中还包含一个插入语they think。

READING MATERIAL

TRADE RECEIVABLES AND PAYABLES

The terms trade receivables (应收账款)and trade payables (应付账款)usually refer to receivables and payables arising in regular course of the company’s transactions with customers and suppliers. Payments normally are to be made within 30 to 60 days. If an advance(预付款)is made to an employee or officer of the company, it should not be included here, nor should advances to affiliated companies (关联公司),such as subsidiaries (子公司),be included. Such receivables should be recorded in separate accounts. In many instances such receivables are not current, and as a result, these items are often seen in the balance sheet under a noncurrent heading as Other Assets. Advances to subsidiary companies are frequently semi-permanent, and they are found in the balance sheet under the Investments caption.

Likewise, trade accounts payable consist only of open(尚未偿付的) accounts owing to the purchase of merchandise or materials or to the acquisition of services from outsiders. Amounts that a firm owes for salaries and wages and for various types of taxes,sundry accruals,and so on are recorded in separate current liability accounts.

The principal reason for separating trade accounts from other receivables and payables is to facilitate analysis by both the management and outsiders.

LESSON FIFTEEN PROMISSORY NOTES

Promissory notes are often used inmerchandise and property transactions, particularly when the credit period is longer than the typical 30 or 60 days for open accounts. Occasionally, a note is substituted for an open account when an extension of the usual credit period is granted. In addition, promissory notes are normally executed when loans are obtained from banks and other parties.

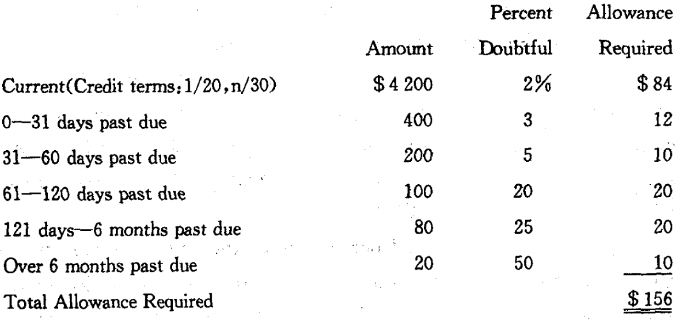

A promissory note is a written promise to pay a certain sum of money on demand or at a fixed and determinable future time. The note is signed by the maker, and it is made payable either to the order of a specific payee or to the bearer. The note may be noninterest bearingor it may be interest bearing at an annual rate specified on the note. An interest-bearing promissory note is illustrated in Exhibit 15-1.

(A note held from a debtor is called a note receivable by the holder and a note payable by the debtor. A note is usually regarded as a stronger claim against a debtor than an open account because the terms of payment are specified in writing. Although open accounts can be sold (factored), it is much easier to convert a note to cash by discounting it at a bank.

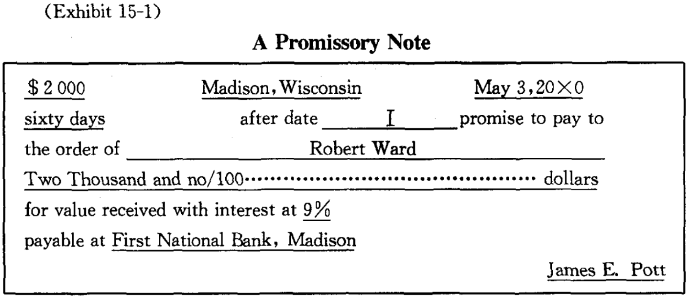

Interest on notes is commonly paid at the maturity date of the obligation, except in certain discounting transactions. Occasionally,a business may prefer not to wait until the maturity date of a note receivable to obtain cash from the customer. Instead, it will endorse the note over to a bank, ‘‘discounting” the note and receiving an amount equal to the maturity value of the note less the discount charged by the bank. By endorsing the note (unless it is endorsed ”without recourse”), the business agrees to pay the note at the maturity date if the maker fails to pay it . Consequently, the note is a contingent liability of the endorser. The discount computation and calculation of proceeds for a $ 4 000, 60-day, 9% note dated March 1 and discounted at 9% on March 31 is as follows:

The discounting transaction should be recorded as follows:

March 31 Cash 4 029.55

Interest Income 29. 55

Notes Receivable Discounted 4 000. 00

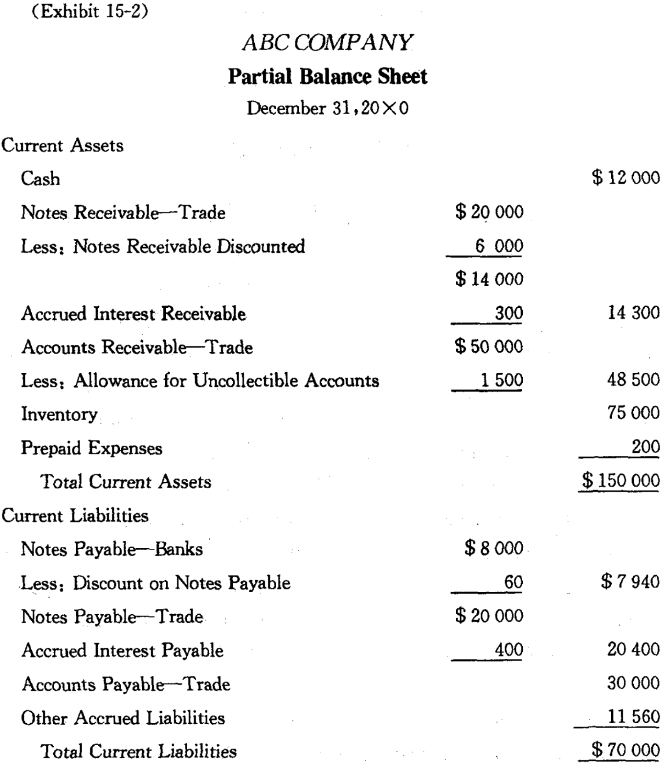

The Notes Receivable Discounted account credited in the above entry is a contra account that is subtracted from the Notes Receivable account in the balance sheet. Only the notes still held by the company are added to the current assets total. Some firms do not exhibit the Notes Receivable Discounted account in the balance sheet; instead, they show the notes still held, with a footnote to this item under the balance sheet indicating the contingent liability.

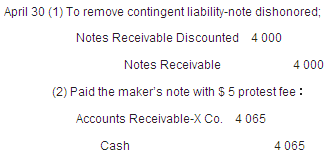

When the maker of a discounted note receivable pays the note at maturity, the discounting party (endorser) may then remove the note receivable amount and the contingent liability contra amount in Notes Receivable Discounted from its accounts. If the maker of a note receivable fails to pay it (dishonors it)at maturity, the bank will notify the endorsing party and charge the full amount owed, including interest, to the bank account of the endorser. In addition, the bank may also charge a small fee called a protest fee. Two entries would be made by the endorser:

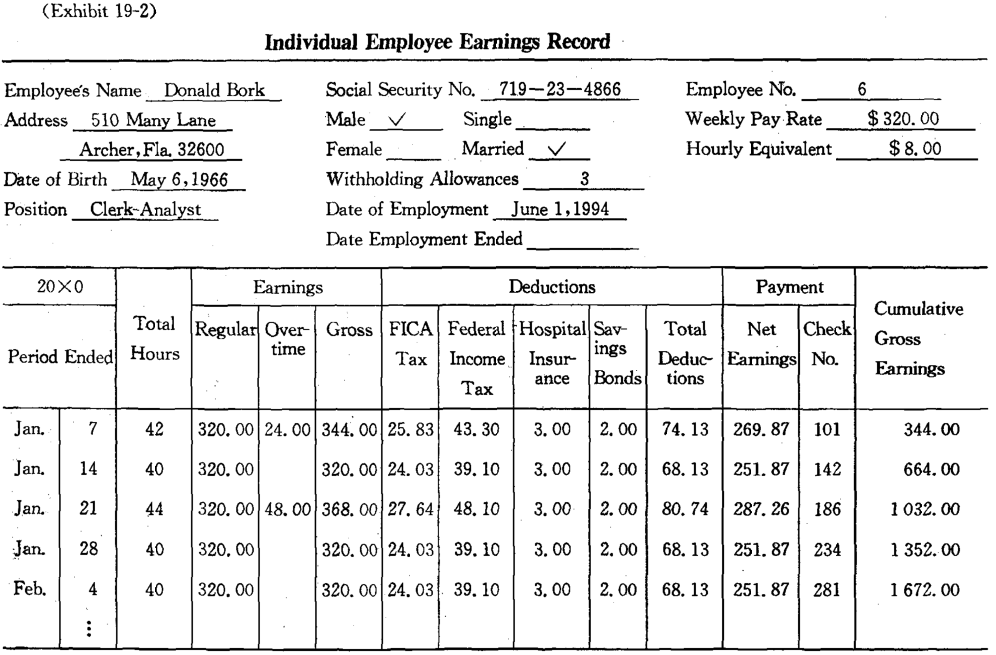

If the endorser failed in its efforts to collect the $ 4 065 from X Company, the account would be written off as uncollectible.