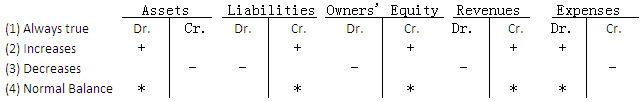

The necessary data for preparing the balance sheet and income statement are accumulated in five major categories of ledger accounts :assets,liabilities, owners,equity, revenues and expenses. An account is simply a record of changes (increases and decreases) and balances in the value of a specific item. The rules of debit and credit applied to each of the five categories of accounts are:

(1)The terms debit and credit are used to describe the left-hand and right-hand sides of any "two-column” account.

(2)Increases in asset and expense accounts are debit entries, while increases in liability, ownersy’ equity and revenue accounts are credit entries.

(3)Decreases are logically recorded on the side opposite increases.

(4)The normal balance of any account appears on the side for recording increases.

These rules can be illustrated graphically as follows:

Under the double-entry bookkeeping system, the twofold effect of every transaction is recorded. Each business transaction should be analyzed into equal debits and credits. Usually the Bookkeeper is able to determine the appropriate accounts to be debited and credited by examining the source documents. For example, a scrutiny of the check stub from the rent payment would reveal the need for debiting Rent Expense and crediting cash.

As a means of formal recording, we shall use a set of journals, or records of original entry, in which business transactions are analyzed in terms of debits and credits and recorded in chronological order. After transactions have been journalized, the debits and credits in each journal entry are transcribed to the appropriate ledger accounts. This transcribing process is called posting to the ledger.

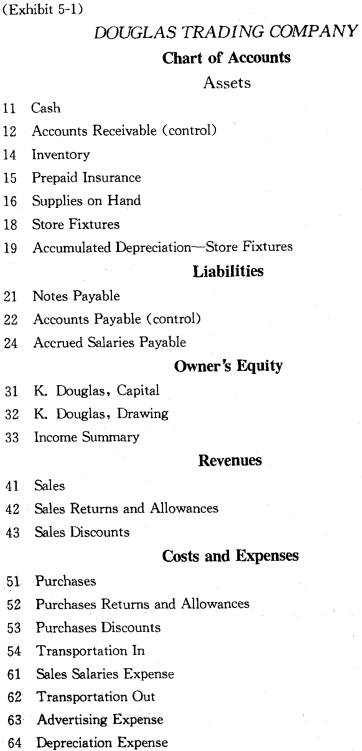

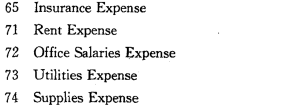

To facilitate the analysis of transactions and the formulation of journal entries, a chart of accounts is usually prepared. It is a listing of the titles and numbers of all accounts found in the general ledger, The account titles should be grouped by and in order of,the five major sections of the general ledger (assets, liabilities,owners’ equity, revenues,expenses). Exhibit 5-1 shows a chart of accounts for Douglas Trading Company.

As we see in the above chart of accounts, a single control account for accounts receivable and another for accounts payable are used in the general ledger. A large number of individual customer and creditor accounts will be maintained in separate subsidiary ledgers. Under this approach,the general ledger is kept to a more manageable size and there is a detailed record of transactions with individual customers and creditors respectively. Examples of other general ledger accounts that often have subsidiary ledgers are Inventory (in a perpetual inventory system), Equipment, and Buildings.

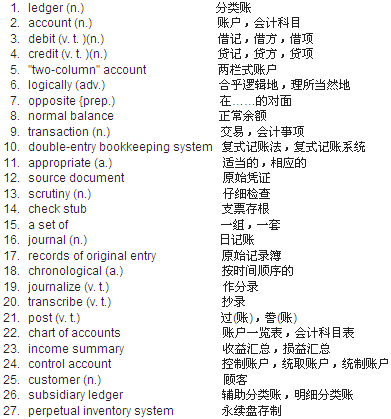

New Words, Phrases and Special Terms

Notes to the Text

1.Increases in asset and expense accounts are debit entries,while increases in liability, owners’equity and revenue accounts are credit entries.

用连词while连接的并列句。

2.As a means of formal recording,we shall use a set of journals,or records of original entry,in which business transactions are analyzed in terms of debits and credits and recorded in chronological order.

(1)介词短语As a means of…修饰全句。

(2)or records of original entry 是a set of journals 的同位语。

(3)全句包含一个非限制性定语从句in which business transactions are analyzed…and recorded…,修饰a set of journals.从句中,用and连接它的两个谓语are analyzed…and (are) recorded …。

READING MATERIAL

THE FORMS OF ACCOUNTS

The account is seen in several forms. In a manually maintained bookkeeping system, the “two-column” account form is often used.

(Account Title)Account No.

|

Date |

Description |

Post. Ref. |

Amount |

Date |

Description |

Post. Ref. |

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

Making an entry in an account consists of recording an amount in the “Amount" column to represent either an increase or a decrease in the account. Spaces are also provided for other types of information-the date of an entry, some memoranda explaining a particular entry, and a posting reference(过账备查,过账记号)(indicated by Post. Ref. ). The posting reference column is used for noting the records from which entries into this account may have been taken.

Another popular form is the “running balance” or“three-column" account(逐笔结计余额式或三栏式账户).

The running balance account contains all the information shown in the two-column account but also provides a balance after each transaction so that the account balance for any date during the period can be easily perceived. If the account balance becomes abnormal (for example,if we overdrew透支our bank balance,the balance of the cash account would be abnormal),it should be placed in parentheses.

(Account Title)Account No.

|

Date |

Description |

Post. Ref. |

Date |

Credit |

Balance (Dr. or Cr.) |

|

|

|

|

|

|

|

|

|