Many of the business transactions affect the net income of more than one period. Clearly, if the income statement is to portray a realistic net income figure based upon accrual accounting, all revenues earned during the period and all expenses incurred must be shown. Therefore, it is often necessary to adjust some account balances at the end of each accounting period to achieve a proper matching of costs and expenses with revenue. The adjusting step occurs after the journals have been posted and a trial balance of ledger accounts has been taken,but before financial statements are prepared.

Adjusting entries made to align revenue and expense with the appropriate periods consist of four types:

- Apportioning recorded costs to periods benefited.

- Apportioning recorded revenue to periods in which it is earned.

- Accruing unrecorded expenses.

- Accruing unrecorded revenue.

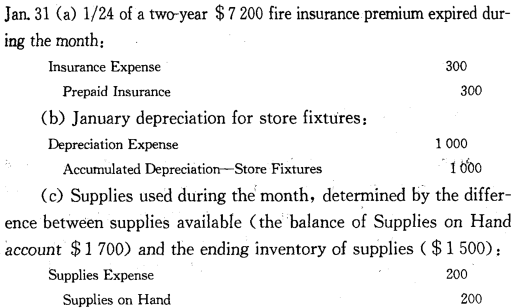

Apportioning Recorded Costs Many business outlays (such as purchases of buildings,equipment,and supplies and payments of insurance premiums covering a period of years) are made to benefit a number of accounting periods. At the end of each accounting period, the estimated portion of the outlay that has expired during the period or that has benefited the period must be transferred from an asset account to an expense account. In our Douglas Company illustration, these adjusting entries would be:

Apportioning Recorded Revenue Sometimes a business (for example, a monthly magazine publisher) receives fees for services before service is rendered. The unearned revenue (here, a three- year subscription for $ 360) shows the obligation for performing future service and is often referred to as a deferred credit. Each month, 1/36 of the publisher’s obligation is fulfilled when magazines are supplied to the subscribers. We would transfer $ 10 from the liability account to a revenue account at the end of each month.

Unearned Subscription Revenue 10

Subscription Revenue 10

Accruing Unrecorded Expenses Often a business will use certain services before paying for them. An obligation to pay for such services as salaries,utilities and taxes may build up or accrue over a period of time. It is necessary to make adjusting entries for such accrued expenses in order to reflect the proper cost in the period when the benefit was received. In our Douglas Company illustration, the adjusting entry for the salaries accrued is as follows:

Jan. 31 (d) To reflect the salaries to employees on services rendered but not paid on Jan. 31:

Sales Salaries Expense 3 000

Office Salaries Expense 1 000

Accrued Salaries Payable 4 000

Accruing Unrecorded Revenue Sometimes a company provides services during a period that are neither billed nor paid for by the end of the period. Yet the value of these services represents revenue earned by the firm and should be reflected in the firm’s income statement. Such accumulated revenue is often termed accrued revenue. The adjusting entry would be as follows:

Accrued Revenue XXX

Service Fees Earned XXX

Merchandise Inventory Adjustment Under a periodic inventory system, a firm determines its merchandise inventory only at the end of each accounting period and adjusts its records through the Income Summary account. For our Douglas Company example, the following adjusting entries are made.

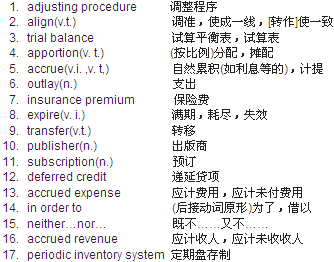

New Words, Phrases and Special Terms

Notes to the Text

1.Clearly if the income statement is to portray a realistic net income figure based upon accrual accounting,all revenues earned during the period and all expenses incurred must be shown.

(1)全句包含一个用连词if引导的条件状语从句。

(2)英语中,副词如clearly,obviously等,常用在句首。这里,dearly=it is clear that.

2. The adjusting step occurs after the journals have been posted and a trial balance of ledger accounts has been taken,but before financial statements are prepared.

全句包含用连词but连接的两个时间状语从句:after和before…。

3. At the end of each accounting period, the estimated portion of the outlay that has expired during the period or that has benefited the period must be transferred from an asset account to an expense account.

用连词or连接的两个定语从句都用来修饰全句主语the estimated portion of the outlay。关系代词that在这两个定语从句中都用主语。

4. It is necessary to make adjusting entries for such accrued expenses in order to reflect the proper cost in the period when the benefit was received

(1)引词it作全句的形式主语,真正主语是不定式短语to make…expenses。

(2)不定式复杂结构in order to reflect…用作修饰全句的状语(表示目的)。

(3)这一不定式复杂结构中,包含一个修饰the period的定语从句。它是用关系副词when引导的。

5. Sometimes a company provides services during a period that are neither billed nor paid for by the end of the period,

(1)定语从句that are…修饰全句谓语动词的宾语services。关系代词that是从句的主语。

(2)从句中两个并列的谓语动词are billed和(are) paid for,用连词neither…nor连接起来。

READING MATERIAL

ACCRUAL BASIS ACCOUNTING AND CASH BASIS ACCOUNTING

In firms that employ an accrual basis (权责发生制)accounting system revenue is recognized when earned rather than when cash is collected and expenses are recognized when goods and services are used rather than when they are paid for. The expenses incurred are matched with the relative revenue earned in order to determine a meaningful net income figure for each accounting period. Yet, certain businesses, principally service enterprises(服务业企业),often use a cash basis (收付实现制)mode of accountinng. In contrast to accrual basis accounting, the cash basis system does recognize revenues when money is received and expenses when money is paid .Cash basis accounting is used primarily because it can provide certain income tax benefits and because it is simple. However, cash basis financial statements may distort the portrayal of financial position and operating results of a business because the revenue and expenses for determining net income do not depend on the time period when cash is actually received or expended. Consequently, most business firms use the accrual basis of accounting.