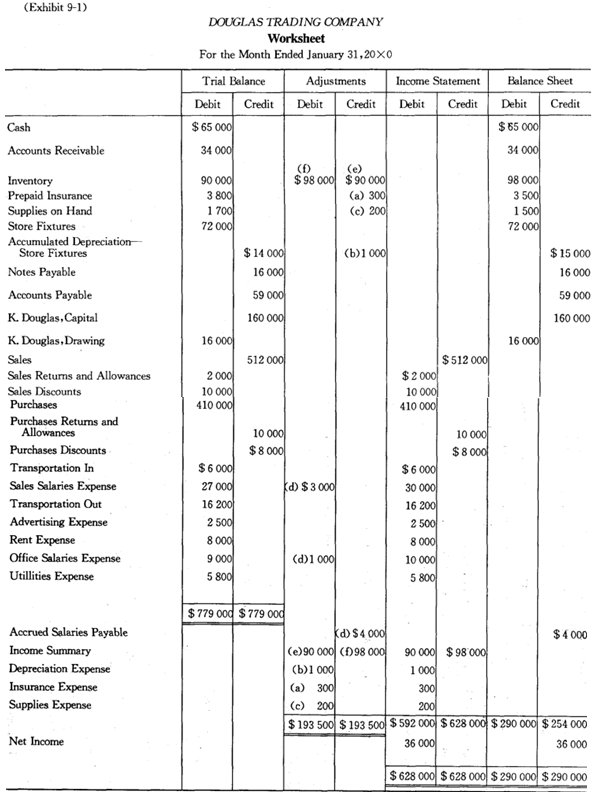

Once the appropriate adjusting entries have been made and posted to the ledger accounts, an income statement and a balance sheet may be prepared directly from the account balances. In actual practice,however, many accountants find that drawing up a worksheet first facilitates the preparation of the statements. The worksheet presented is prepared after all transactions for January have been recorded and posted to the accounts of Douglas Trading Company. A trial balance is taken from the ledger accounts and listed in the first two columns of the worksheet. Adjustments enter on the worksheet directly. Then, the adjusted balances are extended into the income statement and balance sheet columns of the worksheet;they provide the data for formal financial statements.

Once the worksheet is completed, preparing the formal financial statements for the period is a simple matter. The income statement for January and the balance sheet on Jan. 31 prepared from the foregoing worksheet have already been presented in Lesson Four and Lesson Two.

A formal set of financial statements frequently includes a statement of owners’ equity (in the case of single proprietorships and partnerships). As for corporations,a statement of retained earnings would be included. The statement of owners’ equity simply lists the beginning balance,additions,deductions and ending balance of owners’ equity for the accounting period. When capital contributions have been made during the period,we cannot determine from the worksheet alone the beginning balance of owners’ capital and amounts of capital contributions during a period. Consequently, in preparing a statement of owners’ equity, we must examine the owners’ capital accounts in the general ledger. The statement of owner’s equity of Douglas Trading Company for the month of January has been illustrated in the Reading Material of Lesson Three.

When interim (monthly or quarterly) financial statements are being prepared, usually adjustments are made only on the worksheet and will not be recorded in the journal and posted to the ledger accounts. At the close of the calendar or fiscal year, however,the necessary adjusting entries must be recorded in the general journal and posted to the ledger accounts in order to accomplish the proper closing procedures.

New Words, Phrases and Special Terms

Notes to the Text

1. In actual practice, however,many accountants find that drawing up a worksheet first facilitates the preparation of the statements.

(1)句首的介词短语in actual practice修饰全句谓语find that…。

(2)全句谓语动词find的宾语是用连词that引导的从句。

(3)宾语从句中的主语是动名词短语drawing up a worksheet first。

2. Then, the adjusted balances are extended into the income statement and balance sheet columns of the worksheet; they provide the data for formal financial statements.

分号“;”可以用来把两个意义上有一定联系的句子连接在一起。

3. When interim financial statements are being prepared,usually adjustments are made only on the worksheet and will not be recorded in the journal and posted to the ledger accounts.

(1)全句包含一个用连词when引导的时间状语从句。从句中的谓语动词are being prepared系现在进行时态的被动语态形式。现在进行时态有时用来代替一般现在时态,表示经常性的动作或情况。

(2)主句中,第一个连词and连接并列的谓语are made…和will not be recorded…and posted…,第二个连词and 是连接recorded 和posted的。亦即,recorded 与posted并列,are made 和will not be recorded…and posted…并列。

READING MATERIAL

THE TRIAL BALANCE

The trial balance is a list of the account titles in the ledger with their respective debit and credit balances. It is prepared at the close of an accounting period after transactions have been recorded. It should be dated. The two main reasons for preparing a trial balance are:

(1)to serve as an interim mechanical check (中间性的手工操作检查) to determine if the debits and credits in the general ledger are equal.

(2) to show all general ledger account balances on one concise record. This is often convenient when preparing financial statements.

It is always reassuring, of course, when a trial balance does balance. Even when a trial balance is in balance, however, there still may be errors in the accounting records. Among these errors are:

- failing to record or enter a particular transaction.

- entering a transaction more than once.

- entering one or more amounts in the wrong accounts.

- making a compensating error that exactly offsets the effect of another error.

Thus, a balanced trial balance simply proves that, as recorded, the debits equal the credits. When a trial balance is out of balance, it is necessary to search for errors.