When one corporation acquires all or most of another corporation's common stock in a single transaction, the transaction is called a corporate acquisition. The majority investor in this case is called the parent and the majority-owned company is called the subsidiary. When a business is operated as a parent company with subsidiaries, separate accounting records are kept for each corporation. Also, from a legal viewpoint, the parent and each subsidiary are separate entities with all the rights, duties, and responsibilities of a separate corporation. Generally accepted accounting principles require that the financial statements of majority-owned companies be combined or consolidated with those of the parent when the two following criteria are met:(1) the parent owns more than 50 percent of the voting stock of the subsidiary;(2) there are no important restrictions on the ability of the parent to excise control of the subsidiary. A consolidation of the financial statements of the parent and each of its subsidiaries presents the results of operations, financial position, and changes in cash flows of an affiliated group of companies under the control of a parent, essentially as if the group of companies were a single entity.

Purchase method is applied to the acquisition of a controlling interest by purchasing the voting stock from the subsidiary company with cash and noncash assets. Under the purchase method, the assets and liabilities of the subsidiaries are recorded at the amount of cash or fair value of other consideration given in the exchange. The difference between the acquisition cost and the fair value of the identifiable tangible and intangible assets acquired (less the subsidiary's liabilities) represents an unidentifiable asset and is reported as goodwill, which will be tested for impairment at least annually. If the acquirer’s interest in the net fair value of the acquired identifiable net assets exceeds the cost of the business combination that excess (sometimes referred to as negative goodwill) will be recognized immediately in the income statement as a gain in most cases. Immediately after the acquisition by the purchase, the retained earnings balance of the combined entity is that of the parent company only. Therefore, the retained earnings balance of the subsidiary is eliminated and not reported on the consolidated balance sheet. When the consolidated financial statement is being prepared, purchase method requires that intercompany transactions be eliminated to avoid double counting which mainly include parent’s investment, subsidiary's stockholder’s equity, intercompany receivables and payables, revenues, expenses, and dividends.

Before June 30,20 X 0 when the new business combination standard, FAS141, came into effect, an alternative method, called pooling of interest, might be adopted under strictly restricted conditions.

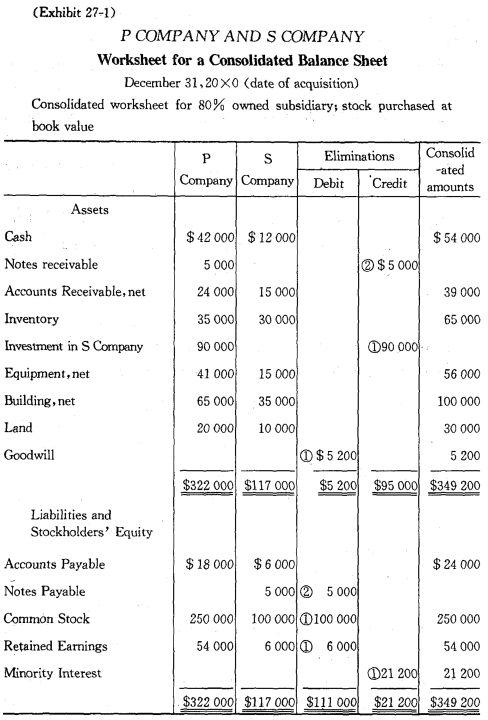

In preparing the consolidated financial statements, worksheets are useful in combining like items of assets, liabilities, revenues, and expenses on a line-by-line basis and making the necessary eliminations of intercompany transactions.

As illustrated in Exhibit 27-1, P Company acquired S Company on December 31,20X0,by purchasing 80% of its outstanding voting common stock for $ 90 000. The book value of S Company is $ 84 800(80% of $ 106 000). The investment in S company appears on P company’s balance sheet. Any excess of cost ($ 90 000) over book value ($ 84 800) increases the value of undervalued assets or is recognized as goodwill from consolidation. It is assumed that no assets are undervalued in our example. The interest in the subsidiary's net asset not owned by the parent company is recognized as the minority interest ($ 21 000,20% of $ 106 000) and is hold by minority stockholders who share in the subsidiary’s income with the parent company. The common Stock and Retained Earnings accounts of the subsidiary also represent an equity interest in the subsidiary's assets. If the investment account and the subsidiary's assets appear on the consolidated balance sheet, the same resources will be counted twice. Therefore, P Company’s investment in S Company must be offset against S Company’s stockholders’ equity accounts so that the subsidiary's assets and the ownership interest in these assets appear only once on the consolidated statement. This elimination is accomplished by entry (1) on the work-sheet. Entry (2) is required to eliminate the effect of the intercompany receivables and payables. On the date it acquired S Company, P Company lended S Company $ 5 000. The loan is recorded as a $ 5 000 note receivable on P’s books and a $ 5 000 note payable on S’s books. If the elimination entry is not made on the worksheet, the consolidation balance sheet will show $ 5 000 owed to the consolidated enterprise by itself. From the viewpoint of die consolidated entity, neither the asset nor the liability exists. Therefore, entry (2) is made on the worksheet to eliminate both the asset and the liability.

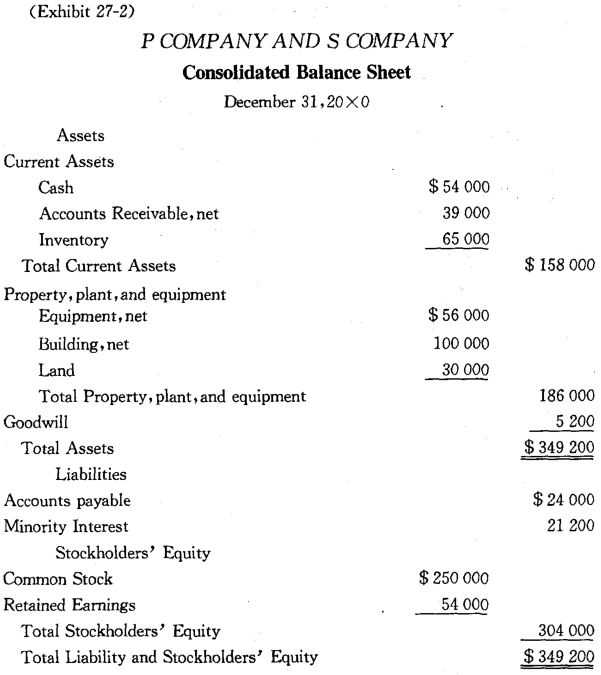

After these elimination entries are made, the remaining amounts are summed up and extended to the column labeled “Consolidated Amounts”. The amounts in this column are then used to prepare the consolidated balance sheet shown in Exhibit 27-2.

Consolidation of the financial statements of a parent company and a subsidiary is a reporting procedure only. This procedure does not affect the accounts of either the parent or the subsidiary and there are generally no separate books for the consolidated entity. Consolidated financial statements are prepared only by the parent company.

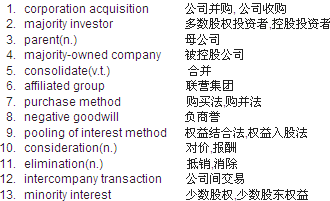

New Words, Phrases and Special Terms

Notes to the Text

In preparing the consolidated financial statements, worksheets are useful in combining like items of assets, liabilities, revenues, and expenses on a line-by-line basis and making the necessary eliminations of intercompany transactions to avoid double counting which include parent’s investment, subsidiary’s stockholders’ equity, intercompany receivables and payables, revenues, expenses, and dividends.

(1)不定式短语to avoid double counting作目的状语,修饰making the necessary eliminations of intercompany transactions 。

(2)定语从句which include parent's investment, subsidiary stockholders’ equity, intercompany receivables and payables, revenues, expenses, and dividends 修饰intercompany transactions。

READING MATERIAL

ACCOUNTING FOR INVESTMENTS

Accounting for investments depends on the purpose of the investment and on the percentage of voting stock that one corporation owns of another. Three types of investments can be identified.

1. Minority(少数股权),passive investment(被动投资).Shares of capital stock of another corporation are acquired for the dividends and capital gains (increase in the market prices of the securities) that are anticipated. The percentage owned of another corporation's voting shares (有表决权股份)is not so large (usually less than 20 percent) that the acquiring company can not control or exert significant influence over the other company. The cost method (成本法) must be used to account for the minority, passive investment. Under the cost method, the investment is measured at the acquisition date at cost in accordance with the cost principle. Subsequent to the acquisition, the investment amount is measured at the current lower or market, and then this amount is reported on the balance sheet under “Investment and Funds". Cash dividends declared by the investee corporation are reported by the investing entity as "Revenue from Investments" in the period declared.

2. Minority, active investments(主动投资).Shares of another corporation are acquired (between 20% and 50% of the outstanding voting stock) so that the acquiring corporation can exert significant influence over the other company’s activities. This significant influence is usually at a broad policy-making level through representation on the other corporation’s board of directors (董事会).The minority, active investment must be accounted for using the equity method(权益法) Under the equity method, the investor corporation recognizes as revenues (expenses) each period its share of the net income (loss) of the investee corporation. Investments on the balance sheet are reported at the acquisition cost plus (minus) the investor corporation's share of the investee’s net income (loss) each period minus the dividends received from the investee each period

3. Majority(多数股权),active investments. Shares of another corporation are acquired (more than 50% of the outstanding voting shares) so that the acquiring corporation (the parent company) can be sure to control the other company at both the broad policy-making level and at the day-to-day operational level. Generally accepted accounting principles require that the financial statements of majority-owned companies (the subsidiaries) be combined, or consolidated, with those of the parent as illustrated in this lesson.